🌐 Lesson 6: Institutional DeFi and Real-World Assets (RWA)

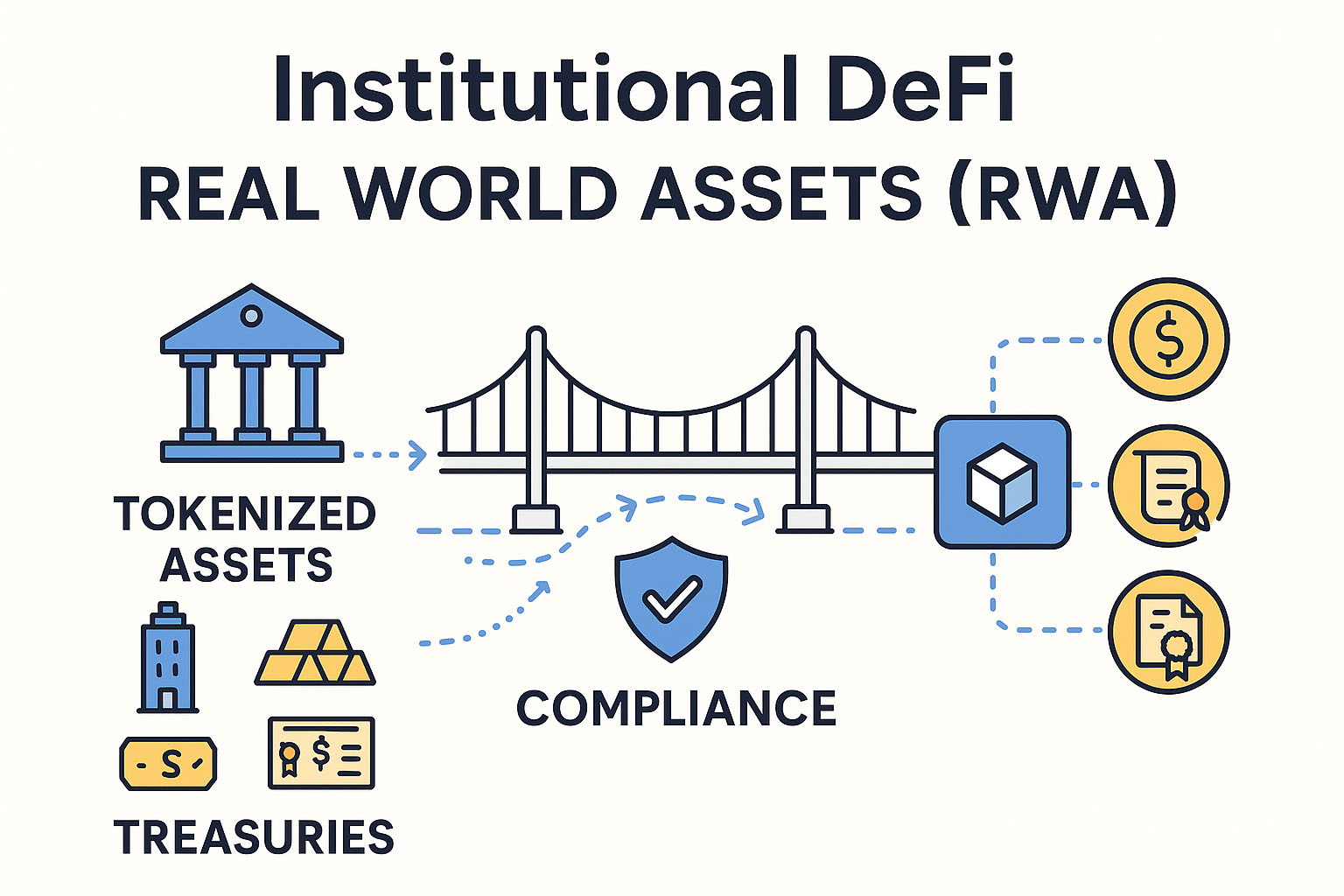

This lesson explores how institutional finance is entering the DeFi ecosystem, driven by innovations in tokenizing real-world assets (RWAs). We’ll examine how this convergence unlocks new financial primitives, enhances compliance infrastructure, and transforms on-chain capital markets.

🔍 Overview

Decentralized finance (DeFi) is no longer confined to crypto-native users and startups. Today, large institutions are exploring the potential of blockchain-based financial protocols. At the same time, DeFi is evolving to include tokenized representations of physical assets—known as Real-World Assets (RWAs)—which bridge the gap between traditional markets and decentralized infrastructure. Together, these trends are reshaping the financial landscape with programmable, global, and transparent alternatives to legacy systems.

What You’ll Need to Know

What You’ll Need to Know

1.Prerequisites:

- Understanding of Layer 1 and Layer 2 blockchain concepts, prior lessons on DeFi infrastructure and scalability.

- Knowledge of DeFi governance, token mechanics

2.Target Audience: Institutional strategists, DeFi builders, regulators, financial analysts

🎯 Learning Objectives

By the end of this lesson, learners will:

- Understand what defines Institutional DeFi and why it matters

- Explore how Real World Assets (RWAs) are tokenized and used on-chain

- Analyze the regulatory and compliance frameworks enabling institutional participation

- Review leading platforms and use cases integrating RWAs and institutional capital

- Evaluate the risks and benefits of merging traditional and decentralized finance

✍️ Content

🏢 What Is Institutional DeFi?

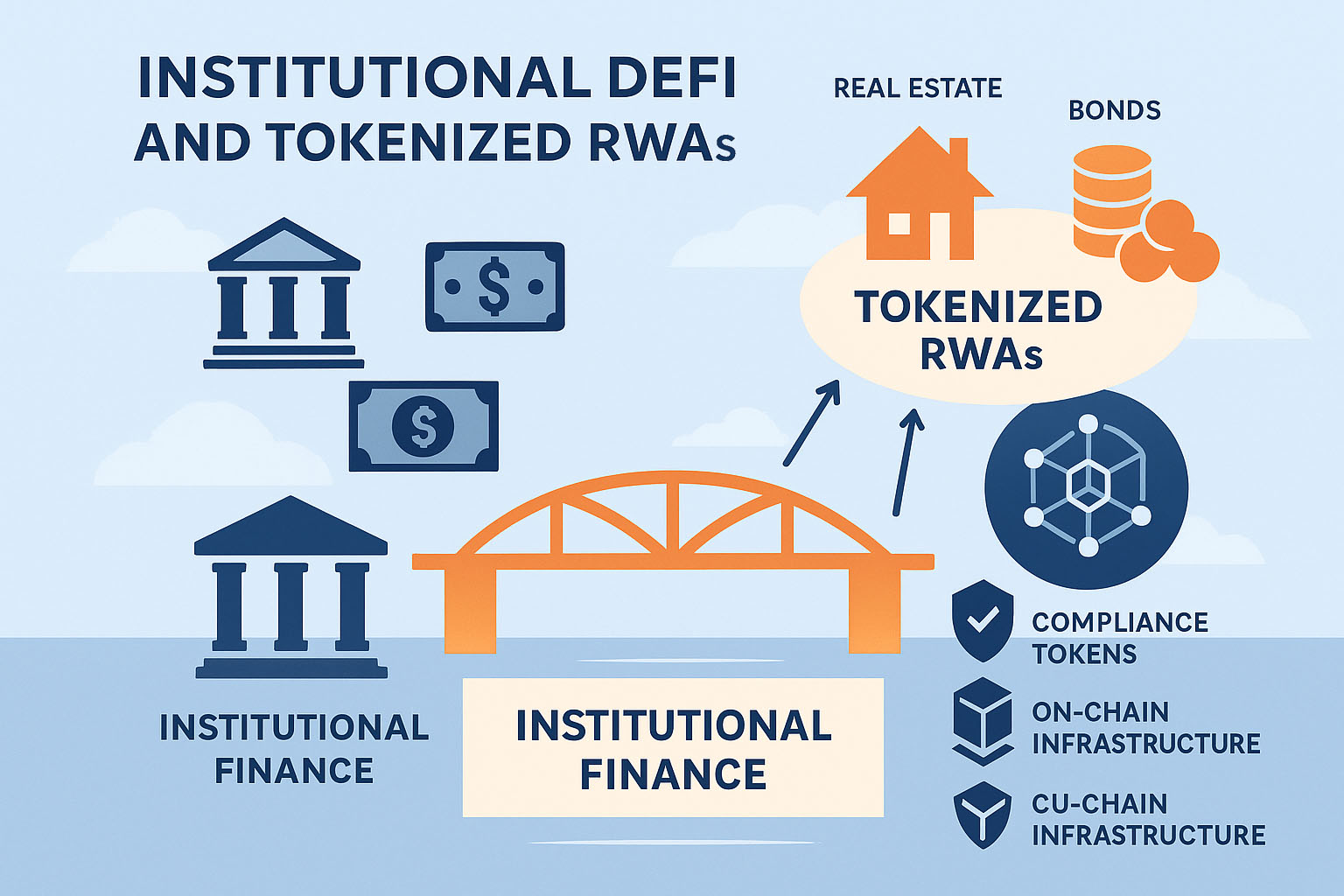

Institutional DeFi refers to the application of decentralized finance by regulated entities such as banks, asset managers, and fintech firms. Unlike public DeFi platforms, institutional DeFi incorporates compliance layers, permissioned access, and integrations with traditional custodians. It allows institutions to benefit from the transparency and efficiency of blockchain while meeting regulatory requirements.

🚀 The Emergence of Institutional DeFi

The rise of institutional DeFi is fueled by growing interest from traditional finance in decentralized infrastructure. Platforms like Aave Arc and Compound Treasury offer permissioned lending pools with KYC-enabled access. Similarly, custodial solutions and on-chain identity tools are being built to support institutional-grade security, compliance, and auditability.

This shift is influencing DeFi design itself. Permissioned liquidity pools, risk scoring systems, and regulated on-ramps are emerging, allowing institutions to engage in yield farming, stablecoin lending, and structured products within trusted, legally compliant environments.

🌍 Real-World Assets in DeFi

Real-World Assets (RWAs) introduce a new dimension to DeFi by anchoring on-chain activity to tangible economic value. These assets include everything from real estate and bonds to invoices and commodities—tokenized and made tradable through smart contracts. RWAs reduce DeFi’s reliance on volatile crypto collateral and provide a pathway for institutional capital to enter decentralized markets.

🏛️ What Are Real-World Assets (RWAs)?

RWAs are tokenized representations of off-chain assets that retain value in the traditional economy. Through legal structures and custodial arrangements, these tokens reflect real ownership, making them suitable for lending, investing, and collateralization on DeFi protocols.

For example, a real estate fund might tokenize property shares into blockchain tokens, allowing fractional investors to access the market, trade their positions, or use them in DeFi applications like liquidity pools or vaults. RWAs thus unlock liquidity and lower entry barriers in traditionally exclusive markets.

🔄 Tokenizing Real-World Assets

Tokenization of RWAs involves three core components:

- Legal Frameworks: Define rights, responsibilities, and asset backing.

- Custodianship: Secure the underlying physical or financial asset.

- Smart Contracts: Issue and manage the RWA tokens on-chain.

By bridging physical ownership with programmable logic, tokenization platforms enable a seamless user experience while maintaining trust and regulatory compliance.

✅ Benefits of Real-World Asset Tokenization

RWAs offer several advantages for DeFi ecosystems:

- Diversification: Reduce reliance on volatile crypto assets.

- Yield Opportunities: Generate income from real-world loans or leases.

- Accessibility: Democratize access to investment-grade products.

- Capital Efficiency: Unlock idle value in illiquid markets.

Institutions also benefit by gaining access to new funding sources and tapping into decentralized liquidity.

🔗 Real World Assets: On-Chain Value, Off-Chain Origins

Several DeFi platforms specialize in managing tokenized RWAs:

- Centrifuge: Facilitates tokenized invoice financing and asset-backed lending.

- Maple Finance: Offers institutional loans through undercollateralized credit markets.

- Goldfinch: Connects DeFi capital with real-world borrowers in emerging markets.

- Ondo Finance: Enables tokenized fixed-income products like US Treasury bonds.

These platforms use oracles, audits, and legally structured agreements to ensure that the tokens remain accurately backed and compliant.

🛠️ Infrastructure and Compliance Layers

Institutional-grade DeFi infrastructure must incorporate robust compliance, security, and governance:

- KYC/AML Integration: Ensure participants meet legal requirements.

- On-Chain Identity: Verify and manage user access across protocols.

- Modular Compliance: Allow protocols to apply jurisdiction-specific rules.

- Custodial Interfaces: Support integration with regulated asset custodians.

This infrastructure enables traditional finance to interact with DeFi tools safely and legally.

🌉 Understanding the Bridge

The bridge between off-chain assets and on-chain tokens requires reliable data pipelines and enforceable contracts. Oracles provide market data and pricing, while legal wrappers ensure that ownership and redemption processes hold up in court. Middleware platforms are now emerging to streamline this integration, offering tools for token issuance, regulatory reporting, and legal reconciliation.

⚖️ Challenges and Considerations

Despite the promise of RWAs, challenges remain:

- Legal Ambiguity: Jurisdictions vary in their classification of tokenized assets.

- Operational Risks: Custodian mismanagement or asset misrepresentation can result in financial loss.

- Liquidity Constraints: RWA markets may have limited buyers and sellers.

- Oracle Failures: Inaccurate pricing data can undermine trust and functionality.

Careful protocol design, insurance mechanisms, and external audits are critical for mitigating these risks.

🔭 The Road Ahead

Tokenized real-world assets and institutional DeFi are converging to form the foundation of the next generation of finance. As regulatory clarity improves and infrastructure matures, DeFi could become a core component of global capital markets. From real estate to treasury bonds, everything of value may one day be represented and exchanged on-chain.

✨ Key Elements

These are the foundational components learners should understand from this lesson:

- Institutional DeFi – The integration of decentralized finance by regulated financial institutions through compliant and permissioned infrastructure.

- Real-World Assets (RWAs) – Tokenized representations of tangible or off-chain assets like real estate, bonds, and invoices.

- Tokenization – The process of converting rights to an asset into a digital token on the blockchain.

- Compliance Infrastructure – Tools and frameworks that enable KYC/AML, legal enforceability, and custodial integration for institutions in DeFi.

- Permissioned Protocols – DeFi platforms with restricted access, designed for institutional-grade use with regulatory oversight.

- On-chain/Off-chain Bridge – Mechanisms that ensure real-world assets can be accurately represented and redeemed via smart contracts.

- Modular DeFi Infrastructure – Stackable components that allow flexibility in integrating compliance, custody, and transparency into DeFi applications.

Related Terms:

Related Terms:

- DeFi (Decentralized Finance)

- TradFi (Traditional Finance)

- RWA token

- KYC (Know Your Customer)

- AML (Anti-Money Laundering)

- Custodial services

- Oracles

- Legal wrappers

- Under-collateralized lending

- Yield strategies

- Tokenized treasuries

- Financial inclusion

- Smart contract risk

- Regulatory sandboxes

- Composability

📌 Conclusion

Institutional DeFi and tokenized RWAs are not side narratives—they are central to DeFi’s future. They invite legitimacy, broaden capital access, and extend DeFi’s benefits to the broader economy. As these systems evolve, they promise to fuse compliance with composability, efficiency with security, and tradition with innovation.

Featured Courses

Capstone: Simulated Web3 Journey

Managing Risks & Red Flags in Web3

Privacy & Transaction Optimization

Using Crypto in Daily Life

NFTs & Web3 Apps in Practice

Introduction to DeFi: Lending, Staking & Yield Explained

Understanding Block Explorers in Crypto

Bridges & Multi-Chain Navigation

Swapping Tokens & Using DEXs

🚀 Advance to the Final Lesson

In the next and final lesson of this track, we’ll explore how all the components of advanced DeFi work together—from governance and scaling to derivatives and interoperability—offering a strategic view of DeFi’s future direction.

Start Final Lesson – DeFi Systems in PracticeJoin the Crypto Hoopoe Community

What You’ll Need to Know

What You’ll Need to Know Related Terms:

Related Terms: