🏛️ Lesson 3: Governance Models in DeFi – Power to the Protocols

This lesson is part of the DeFi Pro Track and explores DeFi governance models, which are critical to protocol decentralization, community involvement, and long-term sustainability.

It delves into how DeFi projects manage upgrades, allocate resources, and involve token holders in decision-making processes through innovative governance mechanisms.

🔍 Overview

In traditional organizations, decisions are made by centralized executives or board members. In contrast, DeFi platforms rely on decentralized governance to ensure transparency, community control, and adaptability. Governance in DeFi is not just about voting—it’s about aligning incentives, fostering collaboration, and managing change in open financial protocols.

What You’ll Need to Know

What You’ll Need to Know

- Prerequisites: Understanding of DAOs, smart contracts, and governance basics from prior DeFi lessons

- Target Audience: Intermediate to advanced DeFi learners, protocol designers, DAO participants

🎯 Learning Objectives

- Understand the principles and importance of decentralized governance in DeFi

- Explore various governance models: token-based, quadratic, delegated, and DAO frameworks

- Analyze case studies of DeFi protocols and their governance evolution

- Recognize common governance challenges, such as voter apathy and whale dominance

- Learn how governance impacts protocol security, innovation, and sustainability

✍️ Content

🧠 What is Governance in DeFi?

Governance refers to the process through which decisions are made within a protocol. In DeFi, it typically involves on-chain or off-chain voting mechanisms where token holders influence protocol updates, treasury spending, parameter changes, and even dispute resolutions.

Effective governance ensures:

- Protocol adaptability

- Community engagement

- Trust and transparency

DeFi governance aims to prevent centralized capture while enabling the ecosystem to evolve with market and technical demands.

🗳️ Governance Mechanisms

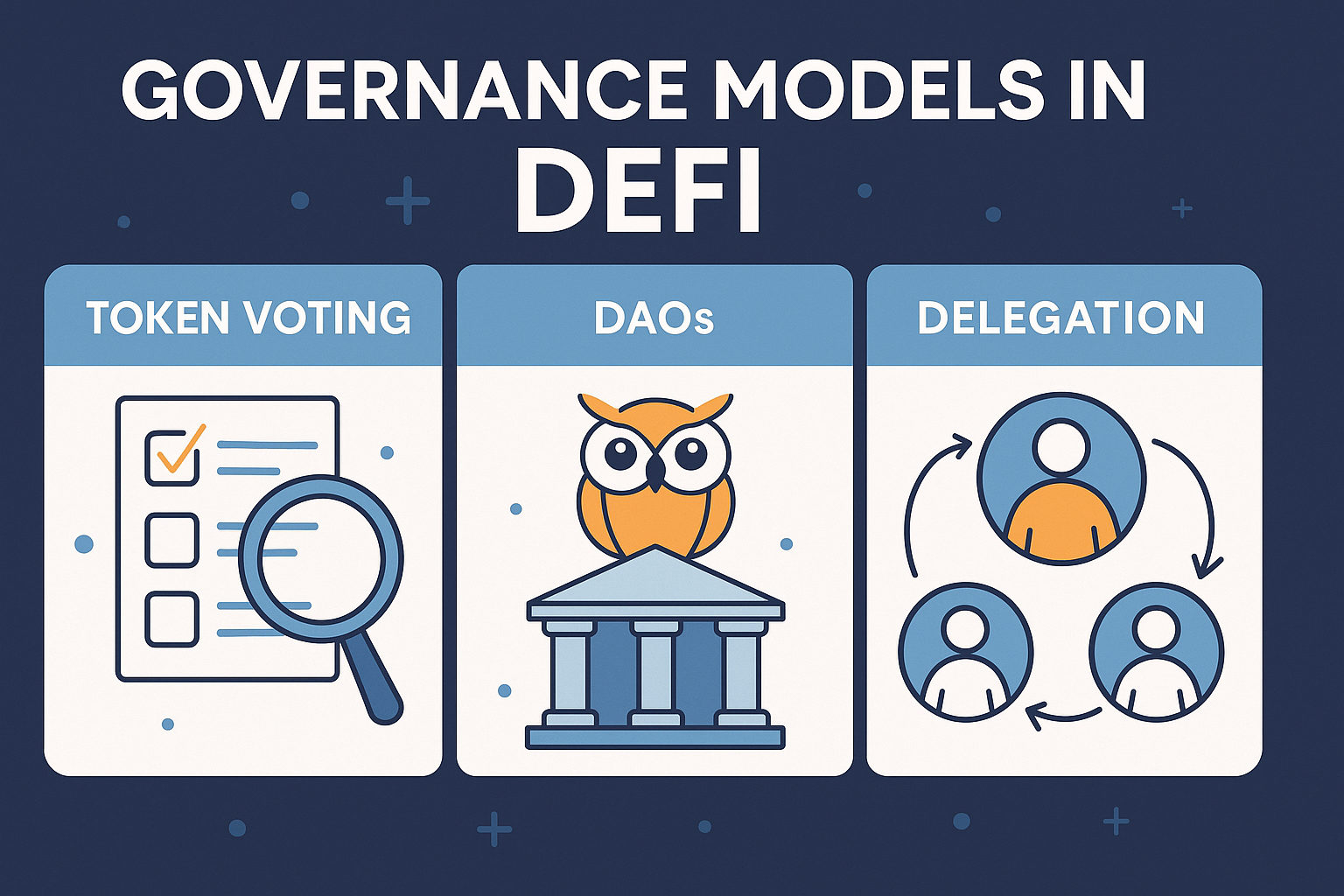

There are several models by which DeFi protocols govern themselves. Each model has strengths and trade-offs in terms of decentralization, efficiency, and inclusivity.

1.Token-Based Voting

- One token equals one vote (e.g., Compound, Aave)

- Simple but vulnerable to whale control and vote buying

2.Delegated Governance

- Token holders assign their votes to representatives (e.g., Uniswap, Aragon)

- Enhances participation by lowering barriers

- Introduces a layer of accountability to delegates

3.Quadratic Voting

- Voting power grows non-linearly with tokens spent

- Aims to reduce the dominance of large holders

- Still under experimentation due to complexity

4.DAO Governance

- Fully autonomous and transparent systems that execute votes via smart contracts

- Examples include MakerDAO, Yearn Finance

- Code is law: changes are implemented automatically based on vote outcomes

🧪 Governance in Practice – Case Studies

- MakerDAO: Pioneered DAO-based governance for stablecoin policy and collateral management

- Compound: Introduced the governance token (COMP) to let users vote on key parameters

- Curve Finance: Implements vote-locking (veCRV) to incentivize long-term governance engagement

Each model demonstrates trade-offs between decentralization, complexity, and participation.

⚠️ Governance Challenges

While decentralized governance is a powerful concept, it also introduces new challenges:

- Low Voter Turnout: Many users don’t engage with governance

- Whale Influence: Large token holders can dominate votes

- Governance Attacks: Malicious actors can exploit low participation

- Information Asymmetry: Not all voters are equally informed

Projects are addressing these issues by:

- Incentivizing participation with rewards

- Introducing time-locked voting

- Educating users through governance dashboards and forums

🧩 The Future of DeFi Governance

As the ecosystem matures, governance models are evolving:

- Meta-Governance: Protocols like Yearn use one DAO to vote across multiple ecosystems

- AI & Reputation Systems: Experimental tools to assist informed, fair decision-making

- On-chain Execution: Moving from proposals to automated code deployment

Decentralized governance is no longer optional—it’s foundational to maintaining DeFi’s core values.

✨ Key Elements

- Token-weighted voting

- DAOs and smart contract governance

- Delegation and representation

- Governance risks and exploits

- Community participation metrics

Related Terms:

Related Terms:

- Governance Token

- Proposal Threshold

- Vote Locking

- Snapshot Voting

- Treasury Management

- Meta-governance

- Delegated Voting

- Fork Governance

- On-chain Execution

📌 Conclusion

Governance in DeFi represents the beating heart of decentralization. From token-weighted voting to fully autonomous DAOs, each model reflects an evolving effort to democratize financial systems. By understanding governance mechanics, users and builders alike can contribute to shaping the future of open finance. While the path remains experimental, one thing is certain: decentralized governance is the compass guiding DeFi’s long-term direction.

Featured Courses

Capstone: Simulated Web3 Journey

Managing Risks & Red Flags in Web3

Privacy & Transaction Optimization

Using Crypto in Daily Life

NFTs & Web3 Apps in Practice

Introduction to DeFi: Lending, Staking & Yield Explained

Understanding Block Explorers in Crypto

Bridges & Multi-Chain Navigation

Swapping Tokens & Using DEXs

🚀 Advance to the Next Stage

Ready to scale your understanding of infrastructure? Next up, we’ll explore how Layer 2 solutions supercharge DeFi scalability and unlock new performance dimensions.

Start Lesson 4 – Scaling DeFi with Layer 2sJoin the Crypto Hoopoe Community

What You’ll Need to Know

What You’ll Need to Know Related Terms:

Related Terms: