DeFi Derivatives Explained – Unlocking Synthetic Financial Power

🧠 Lesson 2: DeFi Derivatives Explained – Unlocking Synthetic Financial Power

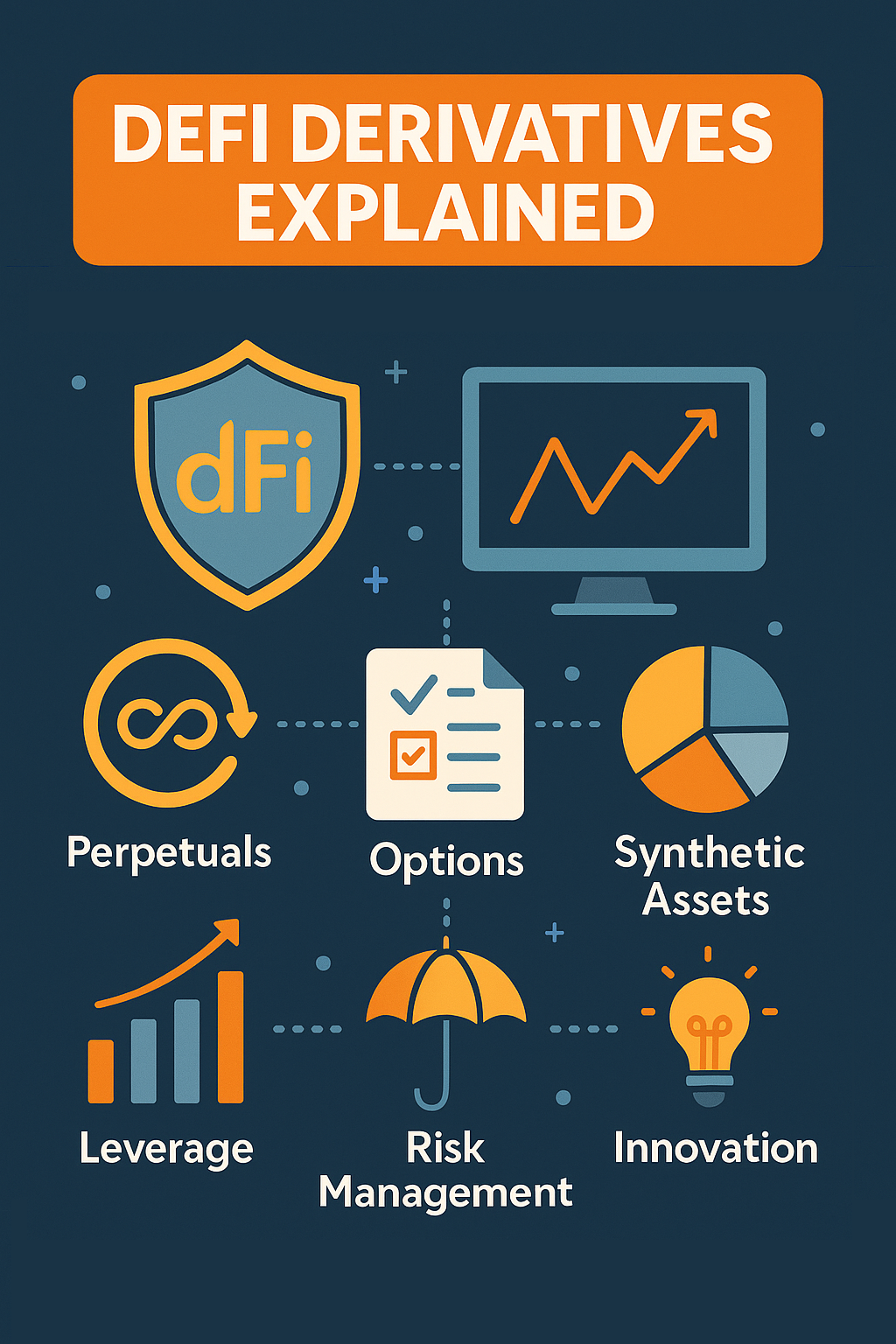

This lesson continues our DeFi Pro Track journey by unraveling DeFi derivatives—the building blocks of decentralized leverage, hedging, and synthetic exposure. From perpetuals to synthetic assets, we dive deep into how DeFi reimagines traditional financial instruments on-chain.

🔍 Overview

DeFi derivatives are smart contract-powered instruments that derive their value from the performance of an underlying asset—just like in traditional finance. However, in the decentralized world, these contracts are transparent, permissionless, and globally accessible. They provide traders with powerful tools to manage risk, gain exposure, and unlock new strategies without holding the physical asset.

📋 What You’ll Need to Know

- Prerequisites:

To get the most out of this lesson, learners should already have:

- A solid understanding of basic DeFi protocols like AMMs, lending platforms, and governance tokens

- Familiarity with smart contracts, liquidity pools, and decentralized exchanges

- Completion of prior lessons in the DeFi Pro Track, especially Lesson 1: Liquidity Infrastructure – AMMs & Hybrids

- Target Audience:

This lesson is designed for:

- Advanced DeFi learners seeking to explore complex financial instruments

- Traders and liquidity providers aiming to hedge, speculate, or leverage positions

- Builders and analysts evaluating on-chain derivatives protocols for integration or strategy

- Anyone interested in how derivatives enable deeper financial markets in Web3

🎯 Learning Objectives

- Understand what derivatives are and how they function in DeFi

- Explore key derivative types: perpetuals, options, futures, and synthetic assets

- Analyze protocol examples like Synthetix, dYdX, GMX, and Lyra

- Identify use cases for hedging, speculation, and liquidity mining

- Evaluate the risks and design challenges involved

✍️ Content

📖 What Are Derivatives?

In finance, a derivative is a contract whose value is linked to an underlying asset—such as BTC, ETH, commodities, or even interest rates. Derivatives are used for hedging against volatility or for speculative trading. DeFi recreates these instruments on blockchain platforms using smart contracts, removing intermediaries and opening up access to anyone with a wallet.

🌐 Types of DeFi Derivatives

The DeFi ecosystem supports several types of derivatives, each with its own characteristics and ideal use cases.

Perpetual Contracts (Perps)

Unlike traditional futures, perpetuals have no expiry date. Their price is kept in line with the underlying asset through a funding rate mechanism.

- Protocols: dYdX, GMX, Perpetual Protocol

- Features: High leverage, real-time trading, non-custodial settlement

- Use Cases: Shorting assets, margin trading, leveraged exposure

Options

Options give users the right (but not the obligation) to buy or sell an asset at a specific price before a certain date.

- Protocols: Lyra, Premia, Opyn

- Key Types: Calls (buy) and Puts (sell)

- Use Cases: Hedging downside risk, income generation via selling options

Synthetic Assets

These are tokenized derivatives that track the value of real-world or crypto assets without holding the asset itself.

- Protocols: Synthetix, Mirror Protocol, UMA

- Examples: sUSD, sBTC, or synthetic Tesla shares

- Benefits: Borderless exposure to stocks, indices, forex, and commodities

Each of these derivatives is powered by on-chain logic, often collateralized by other crypto assets to ensure solvency and trustlessness.

⚙️ Protocol Design & Risk Models

Derivative protocols rely on complex mechanisms to maintain stability and reduce systemic risk.

- Collateralization: Most DeFi derivatives require overcollateralization to prevent underfunded positions.

- Liquidation Engines: Automated systems monitor positions and liquidate them when they fall below collateral thresholds.

- Oracle Integration: Price feeds from Chainlink, Pyth, or custom solutions ensure accurate and tamper-resistant pricing.

- Funding Mechanisms: Used to align perp prices with spot prices by charging fees between longs and shorts.

Without proper design, derivative markets can suffer from front-running, slippage, or protocol insolvency during volatile conditions.

🔍 Use Cases in Action

DeFi derivatives enable a wide range of real-world applications:

- Leverage Trading: Access magnified exposure without full asset ownership

- Risk Hedging: Hedge LP positions or stablecoin exposure with downside protection

- Cross-Asset Exposure: Gain exposure to commodities, forex, and equities synthetically

- Liquidity Mining: Earn rewards by underwriting option positions or providing collateral to derivative pools

These instruments are not only for seasoned traders; DAOs and DeFi protocols also use them to balance treasuries or hedge against market swings.

📉 Risks and Limitations

While DeFi derivatives offer high potential, they carry substantial risks:

- Liquidation Risk: Positions can be force-closed if collateral drops in value

- Oracle Failure: Inaccurate data can lead to wrongful liquidations

- Complex UI/UX: Many derivative platforms are intimidating to new users

- Smart Contract Risk: Bugs in the protocol logic can be exploited, leading to losses

Despite these challenges, derivatives remain one of the fastest-growing segments in DeFi, with evolving risk management solutions and improved user interfaces.

✨ Key Elements

- Smart Contract-Based Derivatives

- Funding Rates & Liquidation Logic

- Synthetic Assets & Mirror Markets

- Options Protocols

- Oracle-Driven Price Accuracy

Related Terms:

Related Terms:

- Delta Neutral

- Margin Ratio

- Overcollateralization

- Funding Rate

- Strike Price

- Synthetic Exposure

- Long/Short Position

- Oracle Manipulation

- Volatility Skew

📌 Conclusion

DeFi derivatives empower traders and protocols to access powerful financial strategies that were once confined to Wall Street. From synthetic assets tracking global markets to perpetual contracts fueling leverage, the space is vibrant and growing rapidly. However, understanding the mechanics, risks, and tools is critical for safe and profitable participation. As DeFi matures, derivatives will continue to play a central role in deepening liquidity, expanding utility, and unlocking capital efficiency on-chain.

Featured Courses

Capstone: Simulated Web3 Journey

Managing Risks & Red Flags in Web3

Privacy & Transaction Optimization

Using Crypto in Daily Life

NFTs & Web3 Apps in Practice

Introduction to DeFi: Lending, Staking & Yield Explained

Understanding Block Explorers in Crypto

Bridges & Multi-Chain Navigation

Swapping Tokens & Using DEXs

🚀 Take the Next Leap in DeFi Mastery

Dive into Governance Models in DeFi to explore how decentralized protocols are governed, funded, and evolved by their communities. Learn the mechanics behind DAOs, token-based voting, and decentralized treasury management.

Start Lesson 3 – Governance Models in DeFiJoin the Crypto Hoopoe Community

Related Terms:

Related Terms: