Cross-Chain Liquidity and Interoperability — Breaking Down Silos in DeFi

🔀 Lesson 5: Cross-Chain Liquidity and Interoperability — Breaking Down Silos in DeFi

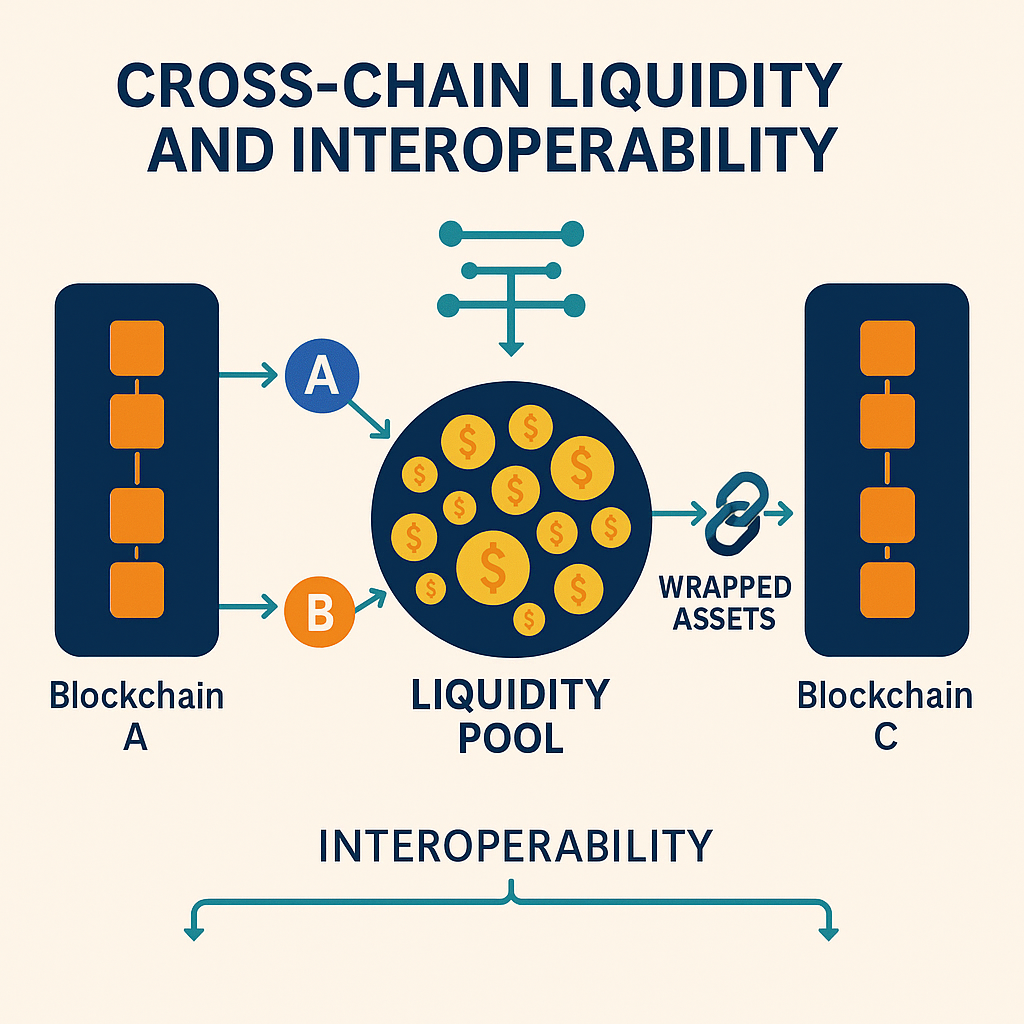

This lesson, part of the DeFi Pro Track, explores Cross-Chain Liquidity in DeFi, a critical innovation driving the next phase of blockchain evolution. As decentralized finance grows beyond single-chain ecosystems, the ability to transfer value and data across multiple blockchains seamlessly has become essential. In this module, we break down the mechanisms and technologies behind interoperability and how they enable a truly connected DeFi landscape.

🔍 Overview

In the early stages of decentralized finance, most activity was siloed within a single blockchain — typically Ethereum. While this allowed for rapid experimentation, it also introduced significant friction. As new blockchains like BNB Chain, Avalanche, Solana, and others emerged with their own DeFi ecosystems, users faced a fragmented landscape that limited capital efficiency and interoperability.

To overcome this challenge, cross-chain liquidity and interoperability have become central themes in DeFi’s evolution. This lesson explores how assets, data, and functionalities now move seamlessly between blockchains, empowering users with more flexibility and enabling protocols to scale beyond a single network.

What You’ll Need to Know

What You’ll Need to Know

1.Prerequisites: Understanding of DeFi basics, smart contracts, and blockchain architecture

2.Target Audience: DeFi developers, power users, protocol designers, and infrastructure analysts

🎯 Learning Objectives

- Understand the need for interoperability between blockchains

- Explore how cross-chain bridges and wrapped assets function

- Discover the role of messaging protocols and omnichain infrastructure

- Identify security risks and trust assumptions in cross-chain systems

- Examine real-world examples of cross-chain DeFi use cases

✍️ Content

🧱 The Case for Cross-Chain DeFi

Decentralized finance was never meant to be confined to a single blockchain. However, each network maintains its own consensus, token standards, and virtual machine — making direct interaction difficult. Without a way to move assets or share state across chains, capital becomes fragmented, and user experience suffers. The rise of cross-chain liquidity solutions aims to unify these islands of value into a fluid, global DeFi system.

This interoperability enhances not just capital efficiency but also resilience, innovation, and inclusion. Protocols can now tap into broader markets, and users can interact with the best applications across chains — all without needing to exit DeFi.

🌉 Cross-Chain Bridges and Asset Wrapping

At the heart of cross-chain functionality are bridges — protocols that lock assets on one blockchain and mint corresponding tokens on another. For example, sending ETH from Ethereum to Avalanche might involve locking ETH in a smart contract and receiving Wrapped ETH (wETH) on Avalanche. These wrapped tokens retain the value of the original asset and can be used within the new ecosystem.

There are trusted bridges, operated by validators or multisigs, and trustless bridges, which use smart contracts or light clients for validation. While bridges enable liquidity mobility, they introduce risk — particularly when controlled by centralized entities or exposed to complex attack surfaces.

Some popular bridges include Wormhole, Multichain (formerly Anyswap), Synapse, and LayerZero, each offering unique mechanisms and levels of decentralization.

📡 Messaging Protocols and Omnichain Functionality

Beyond simple asset transfers, DeFi increasingly relies on messaging protocols like LayerZero, Axelar, and Wormhole’s generic messaging layer. These allow smart contracts to send instructions across chains, enabling actions like cross-chain swaps, lending, or governance.

Omnichain protocols, like Stargate or Thorchain, build natively across multiple blockchains and coordinate liquidity and functionality through sophisticated messaging layers. This architecture shifts the paradigm from bridge-centric to truly interoperable ecosystems.

Moreover, Cross-Chain DEXs such as THORChain and LI.FI enable asset swaps between chains without centralized exchanges. These innovations unlock seamless trading experiences across networks while preserving decentralization.

🔐 Trust Models and Security Concerns

While interoperability offers powerful benefits, it also introduces new attack vectors. Bridges have been among the most targeted systems in DeFi, with exploits on Wormhole, Nomad, and Ronin leading to losses in the hundreds of millions.

The security of cross-chain systems depends on their trust model. Trusted bridges depend on custodians, while decentralized options aim for trustless validation. However, complexity and bugs in smart contracts remain a concern. Audits, rigorous testing, and layered security remain essential for any protocol facilitating cross-chain movement.

🧪 Real-World Examples and Use Cases

Cross-chain capabilities have expanded the possibilities in DeFi, including:

- Yield farming on one chain using assets from another

- Borrowing and lending across ecosystems (e.g., Stargate + Aave)

- Multi-chain DAO governance with tokens bridged across chains

- NFT marketplaces aggregating assets from multiple chains

The ultimate goal is seamless liquidity aggregation, where users and developers interact with applications regardless of the underlying blockchain.

✨ Key Elements

- Wrapped Assets (e.g., wETH, wBTC)

- Bridge Protocols (trusted vs. trustless)

- Interoperability Layers (e.g., LayerZero, Axelar)

- Omnichain DEXs and cross-chain swaps

- Messaging standards and validator sets

Related Terms:

Related Terms:

- Smart Contract Relayers

- Liquidity Fragmentation

- Cross-Chain Finality

- Validator Quorums

- Chain Hops

- General Message Passing (GMP)

- Asset Mirroring

📌 Conclusion

Cross-chain liquidity and interoperability are reshaping the boundaries of DeFi. By enabling decentralized applications to transcend their native environments, these technologies unlock a multi-chain future — one where capital and data flow freely, and user choice is paramount. For DeFi to fulfill its global promise, mastering interoperability will be just as vital as building core applications.

Featured Courses

Capstone: Simulated Web3 Journey

Managing Risks & Red Flags in Web3

Privacy & Transaction Optimization

Using Crypto in Daily Life

NFTs & Web3 Apps in Practice

Introduction to DeFi: Lending, Staking & Yield Explained

Understanding Block Explorers in Crypto

Bridges & Multi-Chain Navigation

Swapping Tokens & Using DEXs

🚀 Advance to the Next Stage

Curious how DeFi is connecting with real-world assets and institutions? In the next lesson, we explore Institutional DeFi and Tokenization of Real World Assets (RWA) — a powerful bridge between TradFi and decentralized finance.

Start Lesson 6 – Institutional DeFi and Real World AssetsJoin the Crypto Hoopoe Community

What You’ll Need to Know

What You’ll Need to Know Related Terms:

Related Terms: