DeFi Systems in Practice – Integrating Advanced Concepts

🌐 Lesson 7: DeFi Systems in Practice – Integrating Advanced Concepts

This final lesson of the DeFi Pro Track brings all the advanced elements of decentralized finance together in one cohesive view. By examining DeFi systems in practice, learners will understand how governance, interoperability, scalability, and various financial instruments integrate to form a resilient and composable financial network. It bridges previous topics into a unified understanding, essential for navigating real-world DeFi applications.

🔍 Overview

Decentralized Finance has evolved into a multifaceted ecosystem where various technologies and mechanisms interact to replicate and enhance traditional financial services. By connecting liquidity provision, governance, derivatives, scalability, and cross-chain solutions, DeFi platforms can build holistic financial ecosystems. In this lesson, we examine these integrations and explore how they shape the new wave of DeFi products, platforms, and protocols.

What You’ll Need to Know

What You’ll Need to Know

1.Prerequisites:

- Understanding of DeFi mechanics (AMMs, lending, staking)

- Familiarity with governance and Layer 2 solutions

- Completion of previous DeFi Pro lessons

2.Target Audience: Builders, DeFi strategists, advanced users, and blockchain developers seeking a complete system-level understanding of how DeFi primitives work in synergy.

🎯 Learning Objectives

- Understand how DeFi systems combine different primitives and tools

- Identify key workflows such as lending, trading, and staking in action

- Explore real-world examples of platforms integrating advanced concepts

- Recognize the strategic role of governance and interoperability

- Learn how DeFi protocols are aligning with regulatory and institutional standards

✍️ Content

🧠 Systems Thinking in DeFi

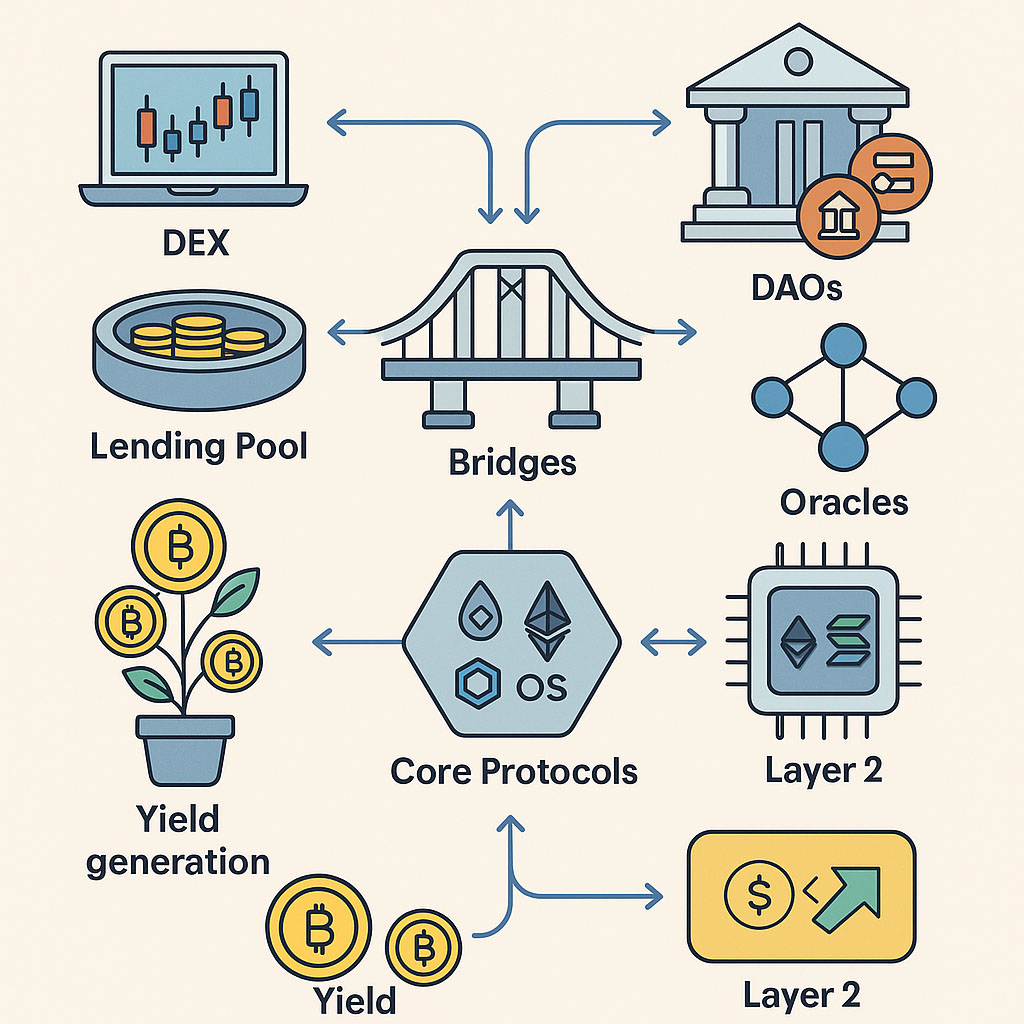

In practice, no DeFi protocol exists in isolation. Liquidity provision, for example, is directly tied to governance structures that define risk parameters and asset listings. Derivatives markets rely on oracles and interoperability to source price feeds and collateral. These connections illustrate that DeFi functions as a system of interoperable financial Legos—each component enhancing the value of the whole.

Take Curve Finance as an example: its success hinges on deep liquidity pools, voting escrow governance, and Layer 2 scaling strategies. Similarly, Synthetix integrates synthetic assets, staking mechanics, and oracle services to deliver decentralized derivatives trading.

🔗 Real-World Integration and Interoperability

Cross-chain protocols are instrumental in making DeFi systems seamless. Bridges like LayerZero, Axelar, and Wormhole enable asset and data flows across chains, allowing users to interact with multiple ecosystems from a unified interface. A user could provide liquidity on Ethereum, use a synthetic asset on Optimism, and claim rewards on Arbitrum—all within one interconnected DeFi journey.

These integrations create more resilient, capital-efficient, and user-friendly DeFi architectures, allowing projects to scale horizontally and vertically.

⚖️ Governance and Coordination

At the heart of integrated DeFi systems is governance—often a mix of on-chain voting, token-weighted proposals, and community coordination. Mature platforms implement tiered DAO structures, delegate voting systems, and even institutional voting blocks to ensure scalability and representation.

Governance influences everything from fee structures and product upgrades to risk thresholds and asset onboarding. Understanding how governance mechanics impact the flow and security of DeFi is essential to mastering advanced usage and participation.

🏗️ Full-Stack DeFi Architecture: A Schematic View

A typical advanced DeFi stack might include:

- Front-end UX: Built on Web3.js or Ethers.js with wallet integrations (e.g., MetaMask, WalletConnect)

- Smart Contracts: AMM, lending, staking, or synthetic asset logic deployed on EVM-compatible chains

- Data and Oracles: Chainlink, UMA, or internal oracle systems feeding off-chain data to the blockchain

- Governance Layer: Protocol token with DAO structure for upgrades and decision-making

- Compliance Middleware: KYC modules, compliance APIs, and identity services (e.g., Polygon ID, zkPass)

- Interoperability Layer: Bridges and relayers to allow cross-chain asset transfers

This layered view reveals how the different lessons in this course converge into a functioning, interconnected DeFi system.

🔮 Strategic Considerations for Builders and Users

When developing or participating in advanced DeFi platforms, understanding systemic dependencies is crucial. For builders, selecting the right primitives ensures security and scalability. For users, evaluating platform integrations can provide insight into platform resilience and potential yield strategies.

As regulation evolves and new modules like RWAs enter the fold, systems thinking becomes more valuable. Platforms that successfully integrate governance, liquidity, scalability, and compliance will lead the next phase of DeFi adoption.

✨ Key Elements

- Composability

The ability for DeFi protocols to interact seamlessly and build upon one another like financial LEGO blocks. - Governance Models

From token-based voting to DAO structures, governance determines how decisions are made and protocols evolve. - Interoperability

Bridges, Layer 0s, and cross-chain communication allowing assets and data to flow between blockchains. - Scalability & Performance

Using Layer 2s, sidechains, and rollups to increase throughput and reduce costs for mass adoption. - Protocol Synergies

How lending, liquidity, derivatives, and asset management protocols integrate to form full-stack DeFi solutions. - Economic Security & Risks

Balancing incentives, audits, oracles, and smart contract robustness to secure TVL and protocol integrity.

Related Terms:

Related Terms:

- TVL (Total Value Locked) – Total capital deposited in DeFi protocols.

- Yield Farming – Strategy of earning rewards by providing liquidity or staking.

- DAO (Decentralized Autonomous Organization) – Member-governed blockchain organization.

- Multichain – Systems or protocols operating across more than one blockchain.

- Oracles – Services feeding real-world data to smart contracts.

- Liquid Staking – Staking with the ability to use derivative tokens in DeFi.

📌 Conclusion

This final lesson ties together everything you’ve learned throughout the DeFi Pro Track. By examining how governance models, liquidity infrastructure, Layer 2 scalability, derivatives, and cross-chain interoperability all play complementary roles, you now have a comprehensive view of DeFi systems in practice.

Whether you’re looking to build, contribute, or strategically invest in decentralized finance, these insights will guide your decision-making and innovation in this rapidly evolving space.

Featured Courses

Capstone: Simulated Web3 Journey

Managing Risks & Red Flags in Web3

Privacy & Transaction Optimization

Using Crypto in Daily Life

NFTs & Web3 Apps in Practice

Introduction to DeFi: Lending, Staking & Yield Explained

Understanding Block Explorers in Crypto

Bridges & Multi-Chain Navigation

Swapping Tokens & Using DEXs

🚀 Ready for the Next Step?

You're now equipped with the skills and knowledge to engage deeply with advanced DeFi platforms. Take your learning further by applying it to real protocols, joining DAOs, or exploring more specialized areas like algorithmic stablecoins, MEV, and DeFi security.

Explore More Advanced TracksJoin the Crypto Hoopoe Community

What You’ll Need to Know

What You’ll Need to Know Related Terms:

Related Terms: