Protocol Design Principles & Patterns

Architecting Scalable, Resilient, and Composable DeFi Protocols from the Ground Up

-

Level

Professional

-

Duration

~1 Hour

-

Lesson

1 of 10

-

Course

DeFi Mastery Track

-

Status

✅ Completed

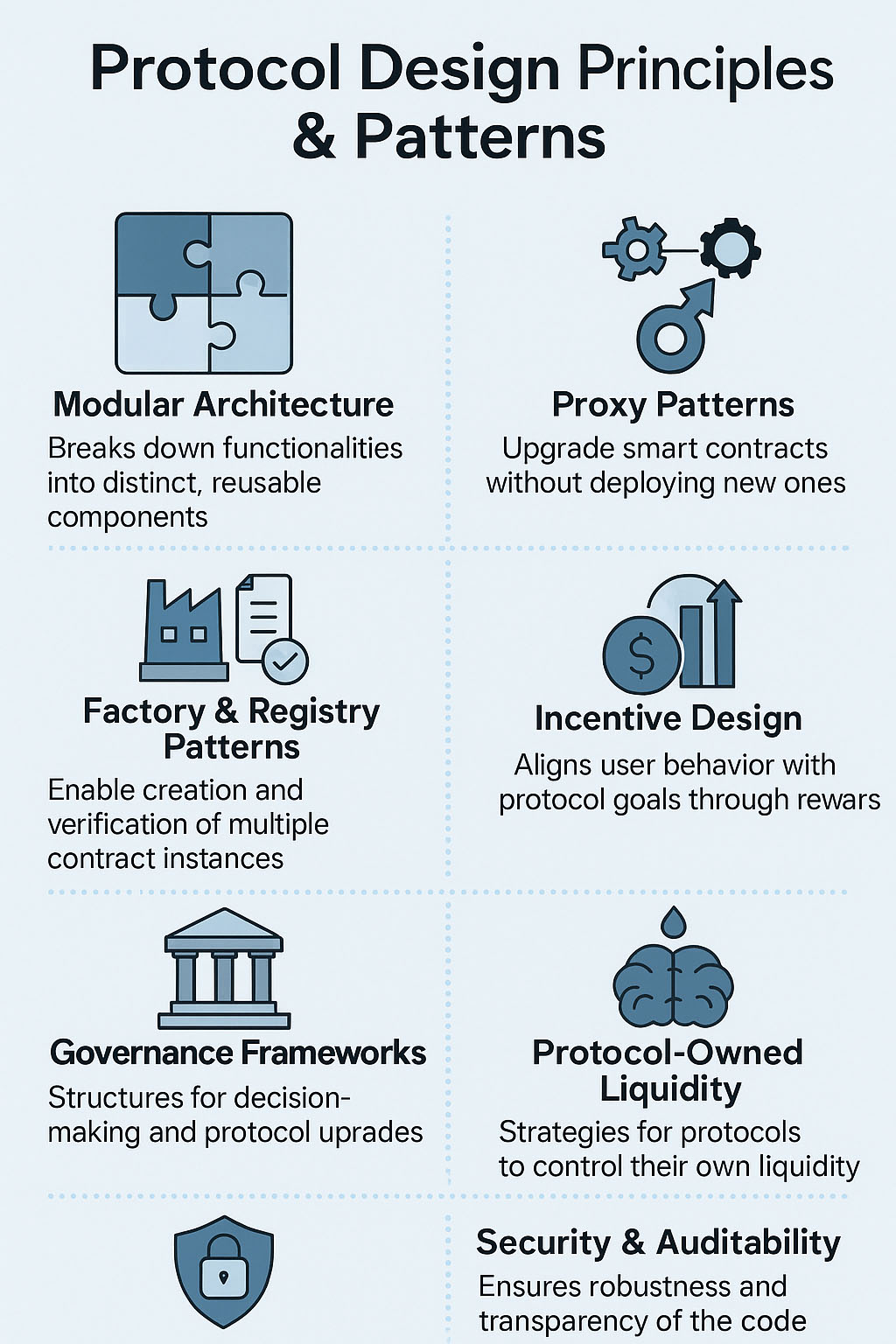

📘 Lesson 1: Protocol Design Principles & Patterns

Building on the foundations of DeFi Systems Engineering, this lesson takes you deeper into the design patterns, principles, and technical architecture that power modern DeFi protocols. You’ll explore how modularity, upgradability, token utility, and governance design intersect to create scalable and secure systems.

Protocol design is not just about smart contracts — it’s about aligning user behavior with protocol incentives while maintaining security, composability, and maintainability. This lesson offers you the architectural blueprints and economic rationale behind some of the most prominent DeFi projects.

🔍 Overview

DeFi protocol design is a multidisciplinary endeavor. It combines software engineering with economic game theory, smart contract abstraction, and decentralized governance. In this lesson, you’ll uncover the architectural and economic principles that shape protocol behavior in the real world. From modular contracts to staking incentives and from proxy upgrades to fee distribution, we walk through how foundational design choices impact protocol evolution, adoption, and resilience.

What You’ll Need to Know

What You’ll Need to Know

1.Prerequisites:

- Working knowledge of Solidity and smart contracts

- Familiarity with core DeFi primitives (e.g., lending, AMMs, staking)

- Exposure to token models and DAO frameworks

2.Target Audience:

This lesson is crafted for:

- Smart contract developers and protocol engineers

- DAO operators and token designers

- Crypto-native researchers and analysts

- Auditors, architects, and DeFi product managers

📚 Lesson Content

Designing a DeFi protocol means balancing functionality, flexibility, and security. You’ll learn how developers leverage modular and upgradeable architectures to enable long-term adaptability, separating governance logic from core protocol operations. We’ll examine patterns such as the proxy contract, factory pattern, and registry pattern, and how these are used to manage upgradability, composability, and expansion.

Economic incentives are a key pillar in protocol design. We break down how staking mechanisms, bonding curves, and fee structures shape user behavior. Through real-world examples like Compound’s interest model and OlympusDAO’s protocol-owned liquidity, you’ll grasp the impact of design decisions on growth, sustainability, and security.

By the end of this lesson, you’ll be able to:

- Analyze how protocol architecture impacts composability and security

- Recognize key upgrade patterns and their trade-offs

- Design incentive-aligned mechanisms for liquidity, governance, or protocol fees

- Interpret smart contract blueprints with a systems-oriented lens

Content

Content

In the rapidly evolving world of decentralized finance, protocol design plays a foundational role in shaping how systems function, adapt, and scale. At its core, a DeFi protocol is more than just a set of smart contracts — it is a programmable financial infrastructure that encodes rules, incentives, and governance. Getting this design right means finding the right balance between performance, modularity, upgradability, and economic alignment.

One of the first decisions in protocol design involves architectural style. While monolithic architectures are simpler to deploy, they often sacrifice flexibility. In contrast, modular design segments functionality across contracts — such as core logic, storage, governance, and access control — allowing for cleaner upgrades and integrations. For instance, protocols like Aave and Compound use controller contracts to route execution while keeping storage isolated for safe contract evolution.

To future-proof a protocol, developers frequently use proxy patterns, especially transparent or UUPS proxies. These enable contract upgrades without changing the contract address that users interact with. By separating logic from storage, protocols can patch vulnerabilities, add new features, or optimize gas usage — all while retaining state and user trust. However, with this flexibility comes added complexity and a need for rigorous testing, permission control, and audit procedures.

Another prevalent design pattern is the factory pattern, which creates standardized smart contracts on demand — useful for launching new markets, vaults, or staking pools dynamically. A closely related pattern is the registry, which tracks and verifies the legitimacy of contracts within the ecosystem. Together, these patterns enhance scalability and composability, key traits in any DeFi protocol.

Incentive design sits at the intersection of game theory and economics. Effective protocols don’t just deploy smart contracts — they align user behavior through carefully designed rewards, penalties, and mechanisms. For example, staking isn’t merely about yield; it can act as an access gate, a governance requirement, or a risk backstop. OlympusDAO pioneered protocol-owned liquidity (POL) by incentivizing users to sell liquidity directly to the protocol via bonding, reducing reliance on mercenary yield farmers.

Token utility is another pillar. Tokens can be purely transactional, like stablecoins; governance-focused, like UNI; or multifaceted, like CRV. The more directly a token is tied to protocol usage and governance, the stronger its flywheel potential. However, this must be balanced with inflation risk, regulatory clarity, and user understanding.

Finally, embedded governance frameworks dictate how a protocol evolves over time. While some systems use snapshot-based off-chain voting, others embrace full on-chain governance via DAOs, treasury control, and parameter tuning. The key challenge is designing governance mechanisms that are both effective and resistant to capture — ensuring that protocol direction remains aligned with its users and contributors.

Altogether, protocol design is a symphony of technical abstraction and economic coordination. Every decision — from upgradeability to fee logic — shapes the protocol’s trajectory, user base, and resilience in an adversarial and fast-moving environment.

✨ Key Elements

- Modular vs. Monolithic Architecture

- Proxy and Upgradeability Patterns

- Incentive Design & Token Utility

- Governance Embedding in Protocol Logic

- Security via Design & Audit Patterns

Related Terms:

Related Terms:

- Factory Pattern

- Proxy Contracts

- Upgradability

- Protocol-Owned Liquidity (POL)

- Governance Modules

- Composability

📌 Conclusion

DeFi protocol design is a critical layer of innovation, risk, and user alignment. With the right patterns, you can build systems that scale securely and govern themselves effectively. Understanding the principles behind today’s most resilient and composable protocols equips you to contribute meaningfully as a DeFi systems engineer.

Featured Courses

Capstone: Simulated Web3 Journey

Managing Risks & Red Flags in Web3

Privacy & Transaction Optimization

Using Crypto in Daily Life

NFTs & Web3 Apps in Practice

Introduction to DeFi: Lending, Staking & Yield Explained

Understanding Block Explorers in Crypto

Bridges & Multi-Chain Navigation

Swapping Tokens & Using DEXs

Explore DeFi Tokenomics & Incentive Engineering

🚀 Continue Your Journey

Now that you understand DeFi protocol architecture, it’s time to explore how protocols sustain activity and coordinate users through tokenomics. Learn how incentives are designed to bootstrap liquidity, align stakeholders, and promote protocol health over time.

Start Lesson 2Join the Crypto Hoopoe Community

What You’ll Need to Know

What You’ll Need to Know Content

Content Related Terms:

Related Terms: