Institutional DeFi & Real-World Asset Tokenization

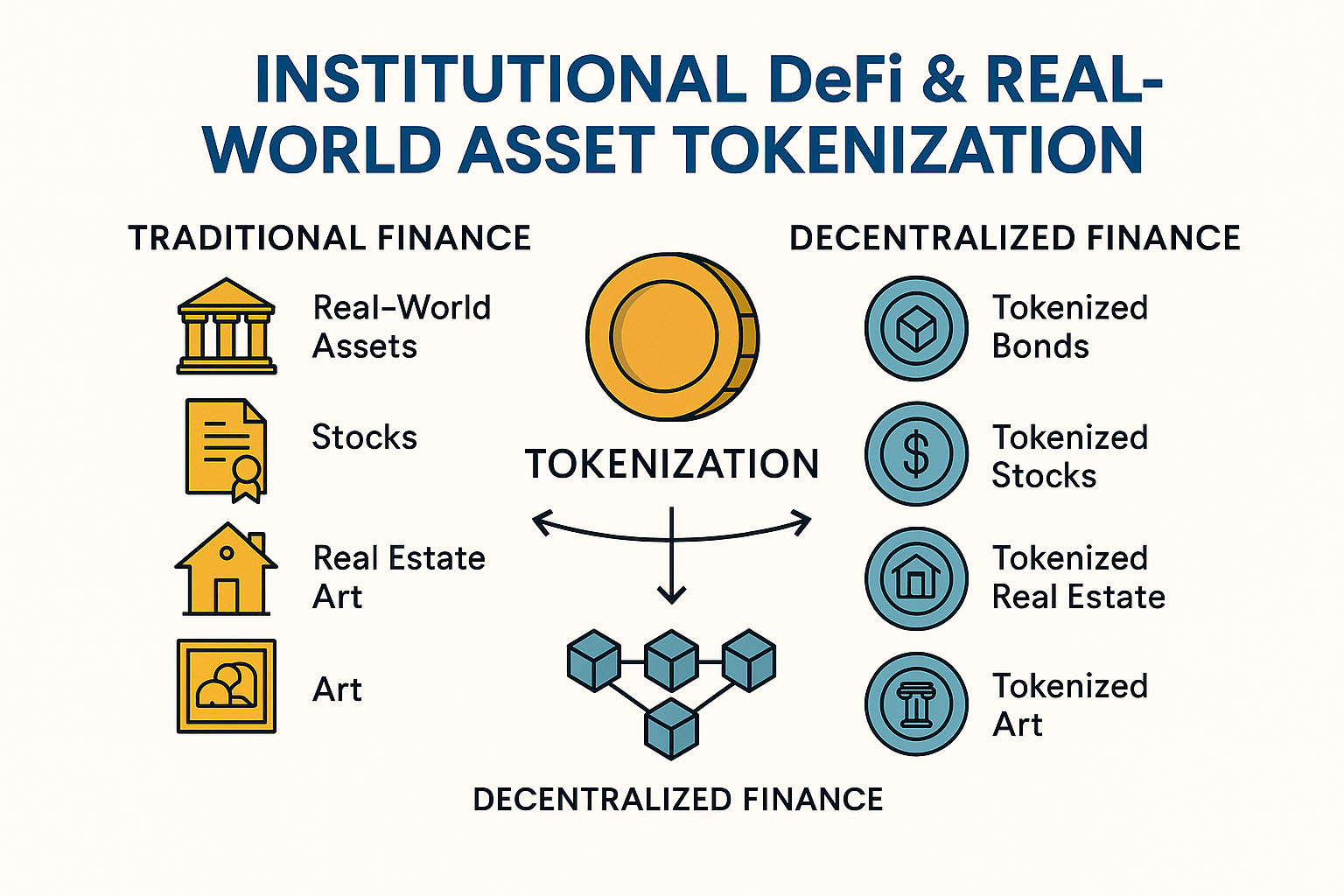

Bridging Traditional Finance and On-Chain Innovation Through Tokenized Real-World Assets

-

Level

Professional

-

Duration

~1 Hour

-

Lesson

5 of 10

-

Course

DeFi Mastery Track

-

Status

✅ Completed

📘 Lesson 5: Institutional DeFi & Real-World Asset Tokenization

Intro

Institutional DeFi and Real-World Asset (RWA) tokenization are rapidly reshaping the financial landscape by merging decentralized protocols with traditional asset markets. As global institutions and fintech innovators seek secure, transparent, and compliant blockchain solutions, tokenizing RWAs unlocks new levels of liquidity, programmability, and fractional ownership. In this lesson, you’ll explore the infrastructure, regulatory frameworks, and architecture that enable this convergence of TradFi and DeFi.

🔍 Overview

This lesson examines how institutions are entering DeFi and how traditional assets—like treasury bonds, real estate, and invoices—are represented as tokens on public or permissioned blockchains. You’ll analyze how on-chain asset issuance, custody, compliance, and yield generation work together to build institutional-grade DeFi ecosystems.

We’ll break down prominent frameworks and examples—like MakerDAO’s RWA vaults, Centrifuge, and tokenized treasury platforms such as Ondo Finance. You’ll also learn about regulatory overlays, permissioned liquidity pools, and how compliance bridges are being built into smart contracts and DeFi rails.

📋 What You’ll Need to Know

1. Prerequisites:

- Solid understanding of DeFi architecture and protocol mechanics

- Basic knowledge of real-world asset classes (e.g., real estate, bonds)

- Familiarity with on-chain and off-chain data integration

2. Target Audience:

- Institutional DeFi architects and strategists

- Asset managers, fintech product teams, and compliance officers

- Developers building tokenized asset platforms or hybrid DeFi stacks

📚 Lesson Content

Tokenizing real-world assets transforms static, illiquid instruments into programmable, tradeable financial products. This convergence is led by a wave of innovation in smart contracts, oracles, legal wrappers, and institutional DeFi frameworks.

✍️ Content

The Rise of Institutional DeFi

Institutional DeFi is defined by the entrance of regulated entities—such as banks, hedge funds, and asset managers—into on-chain financial infrastructure. These players require not only capital efficiency and automation but also compliance, custody, and risk frameworks. As a result, DeFi protocols are evolving to meet institutional standards through KYC-enabled pools, permissioned access, and modular governance.

Protocols like Aave Arc and Compound Treasury are tailored for institutions, offering streamlined front-ends, segregated liquidity pools, and access restricted to verified participants. These systems enable on-chain execution while preserving off-chain compliance, creating a hybrid DeFi layer.

Tokenizing Real-World Assets (RWAs)

RWAs refer to off-chain assets that are represented on-chain through tokenization. This can include:

- Real estate

- Treasury bills

- Private credit

- Invoices and receivables

Platforms like Centrifuge and Goldfinch connect asset originators with on-chain lenders, using tokenized RWAs as collateral. These protocols integrate real-world underwriting with DeFi yield infrastructure.

MakerDAO’s RWA Vaults allow for off-chain collateralized lending, where legal entities interact with the DAO through a trust-based framework. Similarly, protocols like Maple and Clearpool enable institutions to issue debt in a DeFi-native way, with KYC-gated investor pools.

Technical Architecture

Tokenized RWAs require oracles, legal contracts, and bridge mechanisms that ensure asset backing. Chainlink Proof of Reserve, asset registries, and attestation providers play crucial roles. Custody solutions—such as Fireblocks or Anchorage—ensure compliant asset holding, while smart contracts govern issuance, redemption, and default logic.

Integration with stablecoins and DeFi money markets enables composability. RWA tokens can be deposited into protocols to generate yield, serve as collateral, or be traded on secondary markets.

Challenges & Opportunities

The institutional DeFi landscape still faces significant regulatory uncertainty, jurisdictional fragmentation, and technical hurdles in terms of data integrity, legal enforcement, and collateral risk. However, it offers powerful benefits:

- 24/7 settlement

- Increased liquidity for traditionally illiquid assets

- Transparency and programmability

The evolution of token standards (e.g., ERC-3643 for compliant tokens) and partnerships between TradFi and DeFi actors will define the growth of this sector.

- Tokenized Real-World Assets (RWAs)

- Institutional Lending Protocols

- Permissioned Liquidity Pools

- RWA Vaults & Collateral Frameworks

- Oracle Systems & Proof-of-Reserve

- Compliant Token Standards (e.g., ERC-3643)

🔗 Related Terms:

- Institutional DeFi

- Tokenization

- RWA

- Permissioned DeFi

- KYC/AML

- Smart Legal Contracts

- Proof-of-Reserves

📌 Conclusion

The tokenization of real-world assets is a foundational pillar of DeFi’s evolution toward global financial inclusion and capital efficiency. By integrating compliant frameworks with permissionless infrastructure, Institutional DeFi expands blockchain utility beyond crypto-native assets. Understanding these hybrid systems is essential for building the next generation of scalable, trusted financial protocols.

Featured Courses

Capstone: Simulated Web3 Journey

Managing Risks & Red Flags in Web3

Privacy & Transaction Optimization

Using Crypto in Daily Life

NFTs & Web3 Apps in Practice

Introduction to DeFi: Lending, Staking & Yield Explained

Understanding Block Explorers in Crypto

Bridges & Multi-Chain Navigation

Swapping Tokens & Using DEXs

DeFi Risk Modeling: Economic, Technical & Governance Risks

🚀 Continue Your Journey

Understand how to model and mitigate risks in DeFi—from smart contract vulnerabilities to economic attacks and governance exploits.

Start Lesson 6Join the Crypto Hoopoe Community