Liquidity Infrastructure & Automated Market Design

Engineering Capital-Efficient Markets Through Smart Contract Liquidity and Automated Price Discovery

-

Level

Professional

-

Duration

~1 Hour

-

Lesson

3 of 10

-

Course

DeFi Mastery Track

-

Status

✅ Completed

📘 Lesson 3: Liquidity Infrastructure & Automated Market Design

Understanding how liquidity is provisioned, maintained, and optimized is central to the evolution of DeFi liquidity infrastructure. This lesson explores the foundations of capital coordination in decentralized finance—from AMMs and bonding curves to veTokenomics and advanced routing strategies. You’ll examine the architectural and incentive mechanisms that govern how DeFi protocols manage pooled assets, balance slippage, and attract liquidity providers.

In decentralized finance, liquidity is not a side concern — it’s the core utility layer upon which all protocol functionality depends. This lesson explores the strategic and technical foundations of liquidity provisioning and the automated systems that enable efficient, permissionless trading.

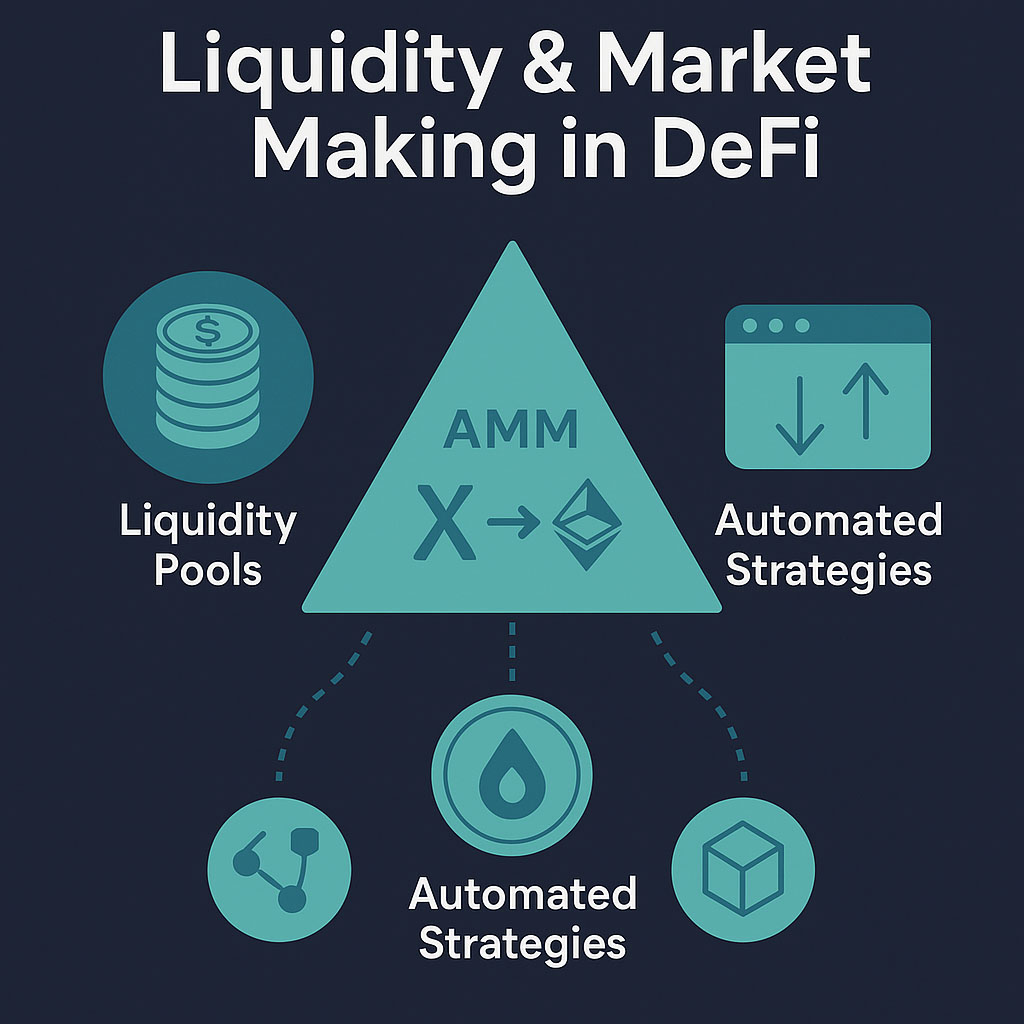

We begin with a shift in paradigm: unlike traditional finance, which uses order books and centralized market makers, DeFi relies on Automated Market Makers (AMMs) and liquidity pools. You’ll learn how these systems operate, why they scale so well in decentralized environments, and how incentives are used to coordinate liquidity provisioning across protocols. We’ll also explore how liquidity design intersects with governance, protocol-owned liquidity models, and cross-asset strategies.

🔍 Overview

Liquidity infrastructure in DeFi plays a critical role in price discovery, asset accessibility, and capital efficiency. The innovation of AMMs allowed DeFi to evolve beyond centralized exchange dependencies. Instead of matching orders, AMMs like Uniswap use mathematical formulas to enable continuous asset swaps based on pool balances and reserve ratios.

But automated liquidity design is not just an engineering feat — it’s a game-theoretic and incentive-coordinated challenge. Protocols compete for capital, and mechanisms like liquidity mining, bonding, and ve-tokenomics have emerged to align LP incentives with protocol goals. We examine the entire liquidity stack: from pool architecture to routing algorithms, to the dynamics of slippage, impermanent loss, and composability.

By understanding how liquidity systems are built and governed, you’ll be equipped to engineer infrastructure that balances capital efficiency, user experience, and systemic resilience.

What You’ll Need to Know

What You’ll Need to Know

1.Prerequisites:

- Familiarity with DeFi trading mechanisms (AMMs, DEXs)

- Understanding of tokenomics and incentive design

- Basic knowledge of smart contracts and pool interactions

2.Target Audience:

This lesson is crafted for:

- Protocol developers designing liquidity mechanisms

- DeFi product managers and economic designers

- DAO contributors working on liquidity coordination

- Advanced DeFi learners exploring capital flow strategies

📚 Lesson Content

At the heart of this lesson lies a detailed exploration of Automated Market Makers — how they differ from order books, the math behind constant product and stableswap functions, and the engineering trade-offs in designing them. We compare models like Uniswap’s x*y=k with Curve’s stable asset curve and Balancer’s weighted portfolios, showing how AMM design is deeply linked to the type of assets being traded.

You’ll also study liquidity pool dynamics: how capital flows in and out of pools, how arbitrage maintains pricing, and how AMM-driven price discovery emerges. From there, we move to liquidity incentives, covering mechanisms like liquidity mining, LP staking, protocol-owned liquidity (POL), and token-based rewards.

As protocols evolve, deeper considerations emerge: How do you manage liquidity across multiple chains? What happens when mercenary capital distorts incentives? What role do veTokens and bonding mechanisms play in long-term liquidity alignment? We’ll explore these questions through case studies of protocols like Curve, OlympusDAO, and Frax.

By the end of the lesson, you’ll have a practical and theoretical foundation for designing liquidity infrastructure that’s sustainable, aligned, and technically robust.

Content

Content

DeFi liquidity infrastructure is not merely a background mechanism — it forms the very substrate through which value flows, trades settle, and capital compounds. Unlike traditional financial systems that depend on order books, brokers, or centralized market makers, decentralized finance reimagines liquidity using automation and smart contracts. At the center of this evolution are Automated Market Makers (AMMs) — self-executing protocols that enable peer-to-contract trading via deterministic algorithms, forming a core pillar of DeFi liquidity infrastructure.

The Mechanics of AMMs

One of the most foundational AMM models is the constant product formula, made famous by Uniswap (x * y = k). This elegant model powers much of the DeFi liquidity infrastructure by enabling token swaps based on reserve ratios. Prices adjust automatically based on supply and demand, with no bid-ask spread, but the model introduces slippage — especially in low-liquidity pools or large transactions.

Curve Finance enhances AMM mechanics using bonding curves optimized for low-volatility assets like stablecoins, minimizing slippage even at scale. Meanwhile, Balancer introduces multi-token pools with customizable weights, effectively transforming liquidity pools into dynamic index portfolios. These innovations reflect the expanding design space in DeFi liquidity infrastructure, where efficiency, volatility management, and capital depth must be carefully balanced.

Incentivizing Liquidity: Yield & Coordination

For any DeFi liquidity infrastructure to function, it requires capital — and capital must be incentivized. Liquidity mining programs offer token rewards to liquidity providers (LPs), introducing strategic complexity. While these rewards attract capital, they can also draw transient “mercenary liquidity” that disappears once rewards end.

To promote long-term alignment, protocols like Curve and Frax introduced veTokenomics. This model encourages users to lock tokens in exchange for governance rights and boosted rewards. Consequently, ecosystems emerge around vote incentives, exemplified by platforms like Convex and Redacted, which coordinate governance influence on emissions and incentives — layering game theory atop DeFi liquidity infrastructure.

A more recent approach is protocol-owned liquidity (POL), introduced by OlympusDAO. Instead of renting liquidity, protocols acquire and manage their own LP tokens. This deepens DeFi liquidity infrastructure by integrating liquidity with treasury and governance, reducing reliance on volatile external incentives.

Multi-Chain Liquidity & Routing Challenges

As DeFi spans multiple blockchains, liquidity becomes fragmented. Routing aggregators like 1inch, Matcha, and Paraswap help mitigate fragmentation by scanning multiple sources for the best swap rates. Cross-chain bridges and messaging protocols — such as LayerZero, Axelar, and Thorchain — aim to unify liquidity across ecosystems, adding scalability while introducing new risk layers.

Modern DeFi liquidity infrastructure must solve for capital efficiency, scalability, user incentives, and governance alignment — all while addressing multi-chain interoperability. As such, designing liquidity systems today requires fluency in economics, smart contract architecture, and behavioural coordination.

✨ Key Elements

- AMM models: constant product, stableswap, weighted average

- Liquidity pool mechanics and LP incentives

- Routing, slippage control, and dynamic fee models

- Protocol-owned liquidity (POL) strategies

- veTokenomics and bonding systems

Related Terms:

Related Terms:

- Automated Market Maker (AMM)

- Liquidity Pool

- Liquidity Mining

- Protocol-Owned Liquidity (POL)

- veTokens / Vote-Escrow

- Bonding Mechanisms

- Slippage & Impermanent Loss

📌 Conclusion

As one of the most dynamic aspects of DeFi infrastructure, liquidity systems shape the user experience, protocol stability, and even the governance structures around them. Automated market design transforms capital into coordination, and understanding its engineering intricacies allows protocol builders to build with long-term composability and trust.

Featured Courses

Capstone: Simulated Web3 Journey

Managing Risks & Red Flags in Web3

Privacy & Transaction Optimization

Using Crypto in Daily Life

NFTs & Web3 Apps in Practice

Introduction to DeFi: Lending, Staking & Yield Explained

Understanding Block Explorers in Crypto

Bridges & Multi-Chain Navigation

Swapping Tokens & Using DEXs

Governance Systems: On-chain vs Off-chain Power

🚀 Continue Your Journey

Explore decentralized governance frameworks, from DAO mechanics to voting power models. Understand how decision-making is embedded in protocol design.

Start Lesson 4Join the Crypto Hoopoe Community

What You’ll Need to Know

What You’ll Need to Know Content

Content Related Terms:

Related Terms: