Crypto Basics Course – Learn Cryptocurrency from Scratch

Crypto Basics Course for Beginners

Welcome to the Crypto Basics Course by Crypto Hoopoe Academy — a beginner-friendly series designed to help you learn cryptocurrency from scratch. Whether you're new to crypto or looking to solidify your fundamentals, this course covers essential topics like blockchain, wallets, stablecoins, and more. Let’s begin your journey into the world of digital assets with our structured and easy-to-follow Crypto Basics Course.

-

Level

Beginner

-

Duration

~30 Minutes

-

Lessons

12

-

Categoty

Crypto Fundamentals

-

Status

✅ Completed

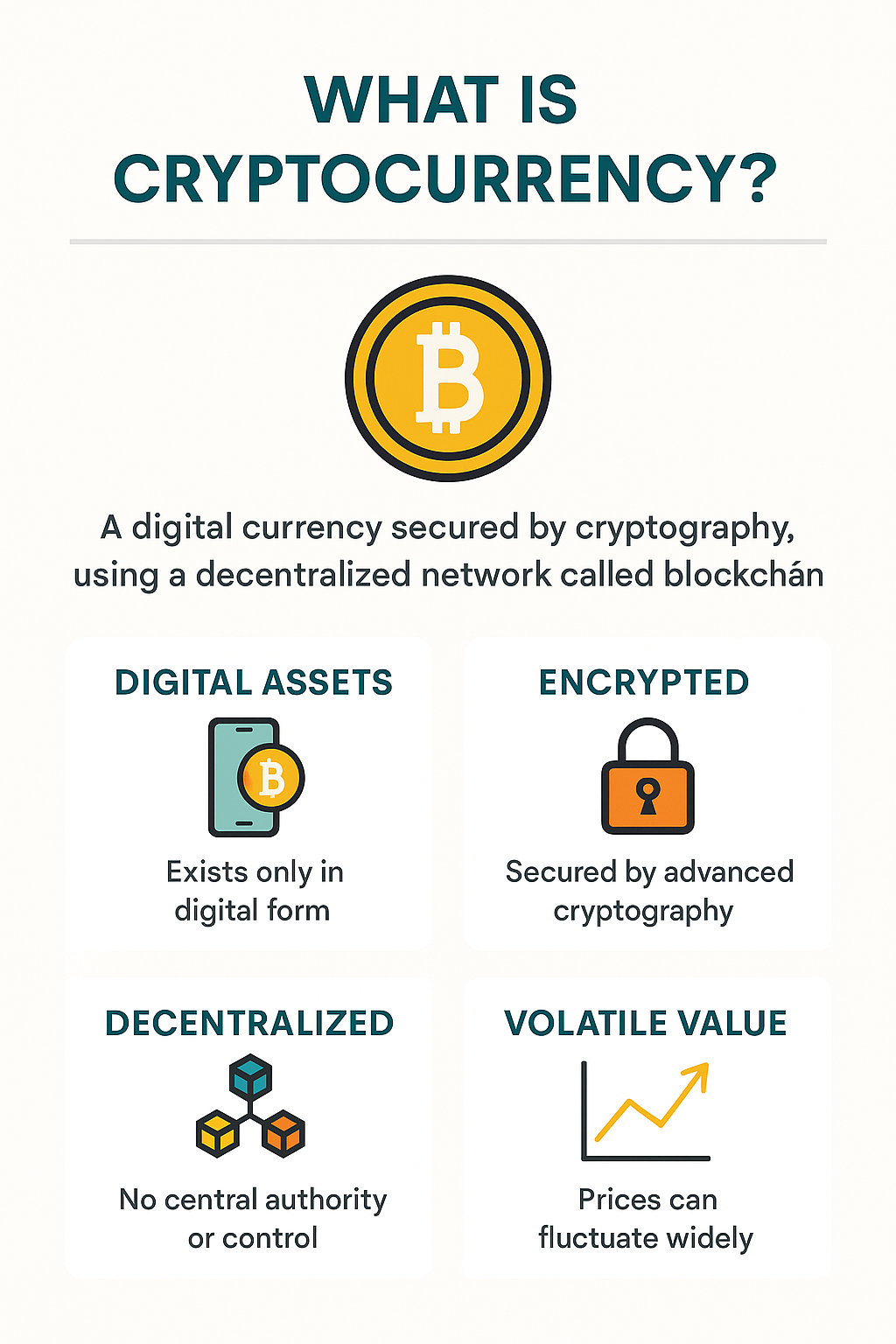

📖 Lesson 1: What is Cryptocurrency?

🔍 Overview

Learn the basic concept of cryptocurrency: what it is, how it works, and why it’s gaining global adoption.

🧠 Learning Objectives:

- Understand the definition of cryptocurrency.

- Differentiate between fiat and crypto.

- Know why decentralization matters

📝 Content:

Cryptocurrency is a digital or virtual form of money that uses cryptography for security. Unlike traditional currencies issued by governments (fiat), cryptocurrencies operate on decentralized networks—usually blockchain-based. Bitcoin, launched in 2009, was the first successful example. Others like Ethereum, Litecoin, and Solana followed.

Key Features:

- Decentralization (no central authority).

- Peer-to-peer transactions.

- Limited supply (in most cases).

- Secure and transparent ledger (blockchain).

🔗 Related Terms:

- Blockchain

- Fiat currency

- Peer-to-peer network

🔍 Overview:

Explore what blockchain is, how it powers cryptocurrencies, and why it’s considered one of the most disruptive technologies today.🧠 Learning Objectives:

- Define blockchain and understand its purpose

- Recognize how blockchain ensures trust and transparency

- Identify key components of blockchain networks

📝 Content:

A blockchain is a decentralized and distributed digital ledger that records transactions across many computers. Each record, or block, is linked to the one before it and the one after it—forming a chain. This structure ensures the security and immutability of the data.Key Elements:

- Blocks: Contain data, a timestamp, and a cryptographic hash

- Nodes: Computers that validate and store the blockchain

- Consensus Mechanisms: Ensure agreement (e.g., Proof of Work, Proof of Stake)

🔗 Related Terms:

- Distributed ledger

- Hash function

- Consensus mechanism

🔍 Overview:

Clarify the distinction between native cryptocurrencies like Bitcoin and Ethereum and tokens that are built on top of existing blockchains.

🧠 Learning Objectives:

Define what a coin is in the context of crypto

Understand what tokens are and how they function

Identify examples of both coins and tokens

📝 Content:

Coins are native digital currencies that operate on their own blockchains. Bitcoin (BTC) operates on the Bitcoin blockchain, while Ether (ETH) operates on Ethereum.

Tokens, on the other hand, are built on top of existing blockchain networks using their infrastructure, especially Ethereum. They can represent assets, access rights, or utility within a platform (like Uniswap's UNI token or Chainlink's LINK).

Main Differences:

Coins: Native, used mainly as money or to pay for network services

Tokens: Built on existing chains, often serve utility, governance, or asset representation roles

Common Token Standards:

ERC-20 (fungible)

ERC-721 (non-fungible/NFT)

🔗 Related Terms:

Smart contract

ERC-20

Native asset

🔍 Overview:

Get to know the different types of crypto wallets and how to securely store and manage your digital assets.

🧠 Learning Objectives:

Understand the purpose of crypto wallets

Identify hot vs. cold wallets

Learn best practices for security and key management

📝 Content:

A crypto wallet is a tool that lets users interact with blockchain networks to store, send, and receive digital assets. Wallets don’t hold your coins directly; instead, they store private keys that give access to your crypto.

Types of Wallets:

Hot Wallets: Connected to the internet (e.g., MetaMask, Trust Wallet)

Cold Wallets: Offline and more secure (e.g., Ledger, Trezor)

Security Tips:

Backup your seed phrase securely

Avoid sharing private keys

Use hardware wallets for large holdings

🔗 Related Terms:

Private key

Seed phrase

Custodial vs. non-custodial wallets

🔍 Overview:

Learn how to send and receive cryptocurrencies safely, verify transactions, and avoid common pitfalls.

🧠 Learning Objectives:

Understand how crypto transactions work

Learn how to send and receive using wallet addresses

Identify key precautions to avoid mistakes

📝 Content:

Transferring cryptocurrency involves sending coins or tokens from one wallet to another. Each wallet has a public address, and to receive crypto, you simply share this address. To send, you'll enter the recipient’s wallet address, choose the asset, and confirm the transaction.

Key Steps:

Open your wallet and select "Send"

Paste the recipient’s address (double-check for accuracy)

Enter the amount to send

Confirm details, pay the network fee, and submit

To receive, select the asset and click "Receive" to generate your public address or QR code.

Safety Tips:

Always triple-check the wallet address

Be aware of network compatibility (e.g., don’t send ETH on the Bitcoin network)

Track your transaction using blockchain explorers

🔗 Related Terms:

Public address

Gas fee

Blockchain explorer

🔍 Overview:

Grasp the fundamental concept of cryptographic keys — the backbone of crypto wallets and secure blockchain transactions.

🧠 Learning Objectives:

Understand the role of public and private keys

Learn how they interact during crypto transactions

Discover the importance of keeping private keys secure

📝 Content:

In the crypto world, wallets rely on a pair of cryptographic keys to function securely — a public key and a private key.

Public Key: Like an email address. It’s derived from the private key and shared openly. It can be used to generate a wallet address, which others use to send you crypto.

Private Key: Like your password. It must be kept secret and secure. Anyone with access to your private key can control your funds.

These keys work together through asymmetric encryption. When someone sends you crypto, they use your public address. To access or move those funds, you must sign the transaction with your private key.

Why It Matters:

Losing your private key is like losing access to your safe. No recovery is possible. That’s why wallet backups and secure storage (e.g., hardware wallets, encrypted files, offline methods) are critical.

🔐 Best Practices:

Never share your private key

Backup your wallet’s recovery phrase

Use a hardware wallet for high-value holdings

🔗 Related Terms:

Encryption

Wallet address

Recovery phrase

🔍 Overview:

Learn how to verify transactions, wallet activity, and on-chain data using blockchain explorers.

🧠 Learning Objectives:

Understand what a blockchain explorer is

Learn how to check transactions and wallet activity

Discover popular explorers for major networks

📝 Content:

A blockchain explorer is a web-based tool that lets you view transactions, blocks, wallet addresses, and network data stored on a blockchain. It offers transparency and verification for all activity.

What You Can Do:

Check the status of a transaction (e.g., pending, confirmed)

View wallet balances and histories

Explore recent blocks and network stats

Popular Explorers:

Ethereum: Etherscan.io

Bitcoin: Blockchain.com Explorer

BNB Chain: BscScan

How to Use It:

Visit a blockchain explorer for your network

Enter a wallet address, transaction ID (TXID), or block number

View detailed data like timestamps, fees, confirmations, etc.

🔐 Why It Matters:

Blockchain explorers help users verify they sent or received funds properly. It’s also key for transparency and research.

🔗 Related Terms:

TXID

Gas fee

Confirmations

🔍 Overview:

Understand frequent beginner errors and how to sidestep them to protect your assets and confidence.

🧠 Learning Objectives:

Identify common mistakes when starting with crypto

Learn practical tips to avoid them

Gain confidence with smart habits

📝 Content:

Many new crypto users make costly mistakes early on. Avoid these pitfalls:

Sending crypto to the wrong address or chain

Losing seed phrases or private keys

Falling for phishing attacks or fake support

FOMO buying during market hype

Not double-checking wallet addresses before sending

Always slow down and confirm details. Use hardware wallets, keep recovery data offline, and never click suspicious links.

🔍 Overview:

Understand what gas fees are, why they exist, and how to minimize them when making blockchain transactions.

🧠 Learning Objectives:

Define gas fees and their purpose

Learn how they're calculated

Discover ways to save on fees

📝 Content:

Gas fees are payments made to miners or validators to process and confirm transactions on blockchain networks. They're most common on networks like Ethereum.

Factors influencing gas fees:

Network demand

Complexity of transaction

Speed of confirmation

Tips to Reduce Gas Fees:

Transact during off-peak hours

Use Layer 2 networks (like Arbitrum, Optimism)

Choose wallets that estimate optimal fees

🔍 Overview:

Explore what decentralized exchanges are and how they differ from centralized ones.

🧠 Learning Objectives:

Define DEX and its key features

Compare CEX vs. DEX

Learn popular DEX platforms

📝 Content:

A decentralized exchange (DEX) allows users to trade cryptocurrencies directly from their wallets, without intermediaries.

DEX Advantages:

No custodial risk (you control your funds)

No KYC (in most cases)

Global access

Examples include Uniswap, PancakeSwap, and SushiSwap.

🔍 Overview:

Learn how to evaluate and choose the best crypto wallet for your needs, based on features, security, and ease of use.

🧠 Learning Objectives:

Identify different wallet types and use cases

Understand the trade-offs between hot and cold wallets

Compare top wallet providers

📝 Content:

Choosing the right crypto wallet depends on your needs:

For everyday use: A mobile hot wallet like Trust Wallet or MetaMask

For long-term storage: A cold wallet like Ledger Nano X or Trezor

For multi-chain access: Wallets like Rabby or Exodus support several networks

Consider user interface, backup options, security features, and supported assets before selecting.

🔍 Overview:

Discover what stablecoins are, how they maintain price stability, and their role in the crypto ecosystem.

🧠 Learning Objectives:

Define stablecoins and their purpose

Explore different types (fiat-backed, algorithmic)

Learn use cases in DeFi and payments

📝 Content:

Stablecoins are cryptocurrencies designed to maintain a stable value, typically pegged to a fiat currency like the US Dollar.

Types of Stablecoins:

Fiat-backed (e.g., USDT, USDC): Backed 1:1 by actual currency reserves

Crypto-backed (e.g., DAI): Collateralized by other crypto assets

Algorithmic: Use smart contracts and supply adjustments to stabilize value

Use Cases:

Hedging against volatility

Earning yield in DeFi

Quick transfers with stable value

🎓 Conclusion – Build Your Foundation with the Crypto Basics Course

By completing this Crypto Basics Course, you’ve taken the first major step in understanding cryptocurrency. Each lesson was crafted to give you the confidence and clarity needed to explore the crypto space further.

Next up? You can continue learning with our [DeFi Essentials Course] or browse our full Crypto Hoopoe Academy library.

💡 Bookmark this Crypto Basics Course and return any time for quick refreshers!

Featured Courses

What Our Learners Say

Ready to Learn?

Curious about crypto but not sure where to start? This course breaks down the blockchain buzz into simple, clear lessons that actually make sense. You’ll go from zero to crypto-savvy—no tech background needed. Let’s unlock the basics and get you confident in your first steps into Web3!

Start Learning Blockchain Join the Crypto Hoopoe Community