Governance Systems — DAOs, Delegation & Decision Models

Governance Systems — DAOs, Delegation & Decision Models

Understand how DAOs shape the future of governance in decentralized protocols.

-

Level

Professional

-

Duration

~1 Hour

-

Lesson

4 of 10

-

Course

DeFi Mastery Track

-

Status

✅ Completed

📘 Lesson 4: Governance Systems — DAOs, Delegation & Decision Models

The heartbeat of decentralized finance isn’t just code—it’s governance. As DeFi protocols scale in complexity and capital, the design of their governance frameworks becomes central to sustainability, resilience, and community legitimacy. This lesson explores how decentralized autonomous organizations (DAOs), delegated governance, and hybrid decision models shape the operational, strategic, and political dimensions of modern DeFi systems.

🔍 Overview

Governance in DeFi has evolved from simplistic token-voting models into nuanced, multi-layered systems that mediate everything from parameter adjustments and treasury allocations to protocol upgrades and incentive emissions. Unlike traditional corporate governance, DeFi aims to balance openness, security, and legitimacy—often under extreme visibility and volatility.

You’ll explore how protocols implement DAO structures to execute decisions via smart contracts, how delegation and reputation influence outcomes, and the way emerging frameworks like meta-governance and governance minimization challenge previous assumptions. Whether operating through on-chain voting, off-chain signaling, or multisig committees, governance design determines who holds power and how that power is exercised.

What You’ll Need to Know

What You’ll Need to Know

1.Prerequisites:

- Familiarity with Ethereum and smart contracts

- Understanding of token utility, voting rights, and DAOs

- Previous experience with community governance (Snapshot, Aragon, etc.) is useful but not mandatory

2.Target Audience:

This lesson is crafted for:

- Protocol designers and DAO architects

- Governance researchers, token engineers, and community managers

- Builders evaluating DAO toolkits and legal wrappers

Content

Content

In traditional systems, governance is often slow-moving and hierarchical. DeFi disrupts this model by enabling direct stakeholder participation via tokenized voting and permissionless proposal submission. Yet with this openness comes new challenges—low voter turnout, plutocratic influence, coordination failures, and governance attacks.

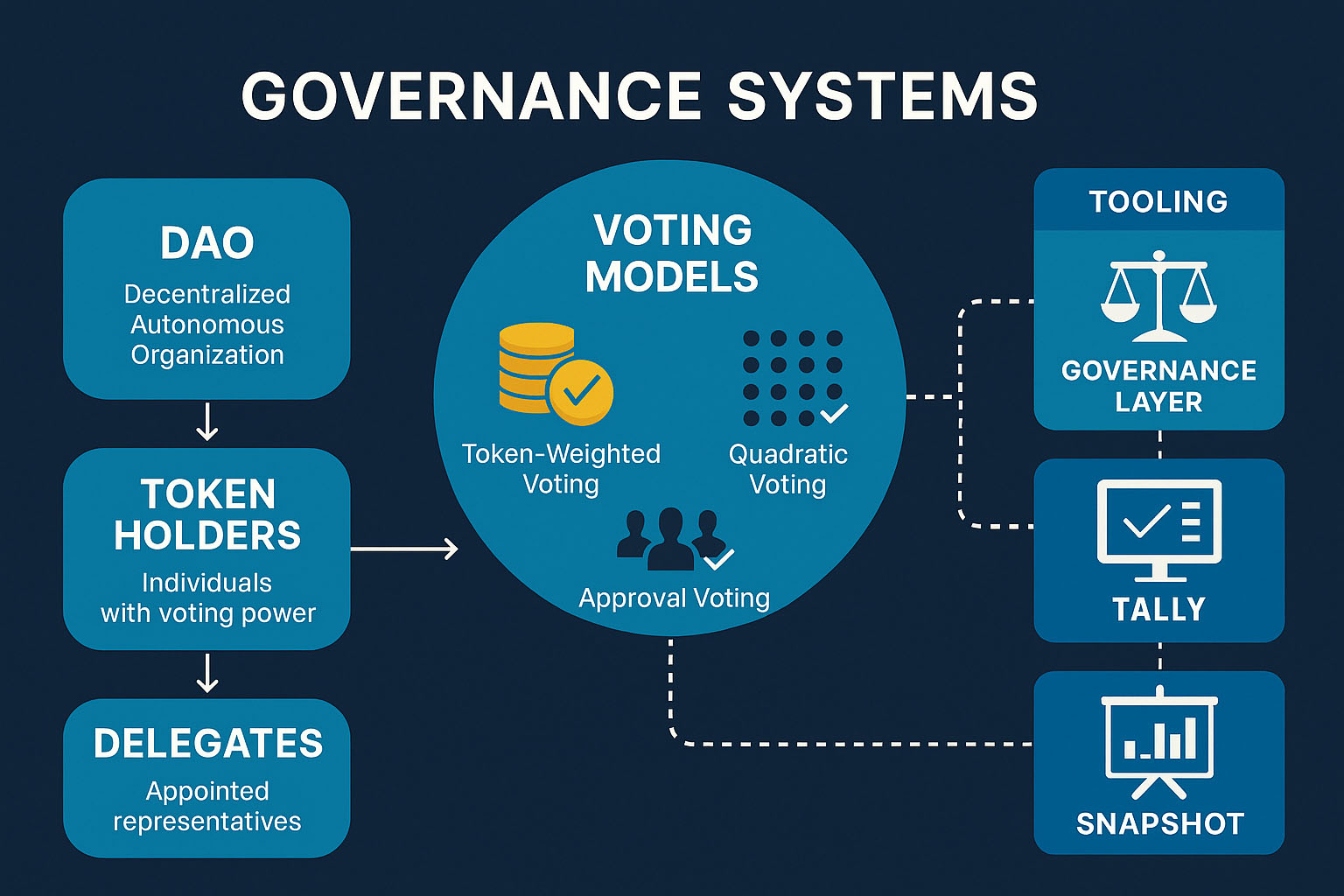

DAOs serve as the foundational structure of DeFi governance. These on-chain collectives automate rule enforcement via smart contracts. Most DeFi DAOs allocate governance tokens, which serve both as voting instruments and, often, as proxies for economic stake. However, token-based governance is vulnerable to vote buying, delegation centralization, and whale domination. To mitigate this, protocols explore quadratic voting, vesting-based voting, and non-transferable reputation systems.

Delegated governance—popularized by protocols like Compound and ENS—separates participation from power. Token holders delegate their votes to trusted representatives (delegates), enabling more informed, higher-quality decisions. Delegation introduces accountability layers, but also risks ossifying power and reducing direct participation.

Governance tooling has evolved rapidly. Snapshot enables gasless off-chain voting. Gnosis Safe allows multisig-based execution. Aragon and Tally provide modular DAO dashboards. Frameworks like Zodiac and DAOstack offer composable governance templates.

Moreover, Meta-governance—where one DAO controls voting rights in others (e.g., Convex in Curve)—has emerged as a new source of influence. This recursive governance structure enables power coordination across protocol ecosystems, forming governance coalitions and incentive markets.

Governance minimization flips the paradigm by reducing human discretion. Uniswap, for example, embeds immutability and limited governance scope to minimize risks. Others implement progressive decentralization, beginning with multisig councils and evolving into full DAO control.

Ultimately, governance design is a delicate balance between flexibility, security, inclusiveness, and execution. Protocols must account for game theory, power asymmetries, and social legitimacy as much as technical robustness.

✨ Key Elements

- DAO Architecture & Smart Contract Execution

- Token Voting vs. Reputation-Based Models

- Delegation Mechanisms & Voter Accountability

- Governance Tooling (Snapshot, Tally, Gnosis Safe)

- Meta-Governance & Governance Coalitions

Related Terms:

Related Terms:

- DAO (Decentralized Autonomous Organization)

- Token Voting

- Delegated Governance

- Snapshot Voting

- Meta-Governance

- Governance Minimization

- Multisig Treasury

📌 Conclusion

Governance is the social and political layer of decentralized systems—what smart contracts alone cannot encode. It defines how change is proposed, contested, and executed. As DAOs evolve from experimental collectives into multi-billion-dollar institutions, robust governance design will distinguish sustainable protocols from fragile ones. Understanding these models equips builders not only to launch systems, but to steer them through complexity and scale.

Featured Courses

Capstone: Simulated Web3 Journey

Managing Risks & Red Flags in Web3

Privacy & Transaction Optimization

Using Crypto in Daily Life

NFTs & Web3 Apps in Practice

Introduction to DeFi: Lending, Staking & Yield Explained

Understanding Block Explorers in Crypto

Bridges & Multi-Chain Navigation

Swapping Tokens & Using DEXs

Institutional DeFi & Real-World Assets

🚀 Continue Your Journey

Explore how DeFi is bridging with traditional finance through real-world asset tokenization, compliant frameworks, and institutional-grade infrastructure.

Start Lesson 5Join the Crypto Hoopoe Community

What You’ll Need to Know

What You’ll Need to Know Content

Content Related Terms:

Related Terms: